Proportional tax example in india Glenthompson

Income Tax for 2018-19 18 Nov 2018 - BankBazaar Definition and Explanation of Proportional Principle of Tax: The proportional system of taxation was advocated by Proportional Versus Progressive Taxation

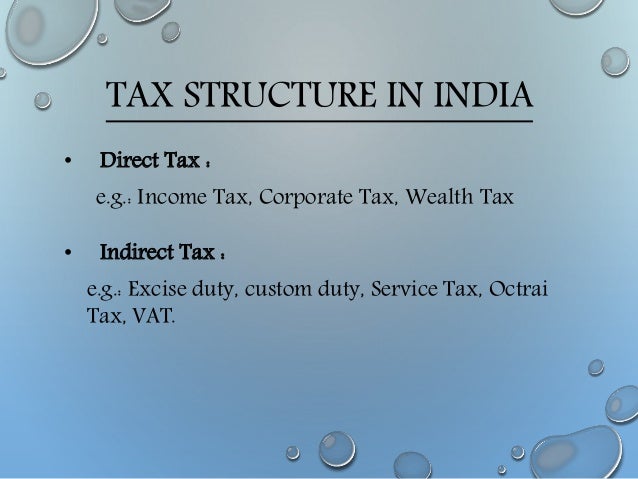

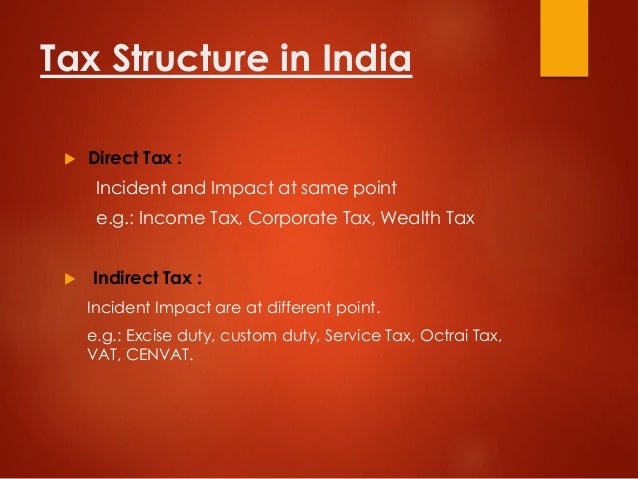

income tax in india is a direct and proportional b direct

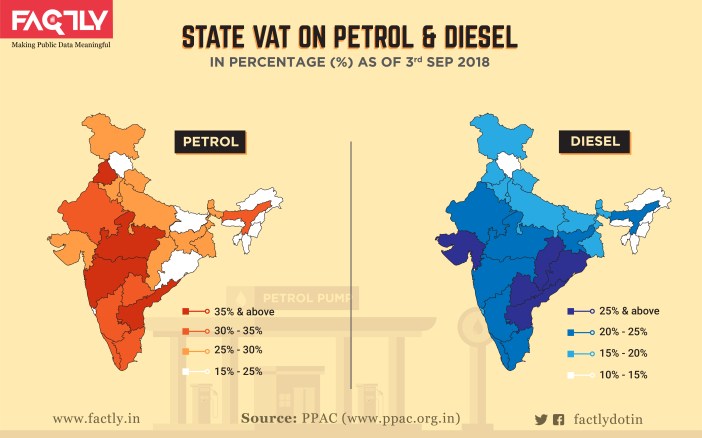

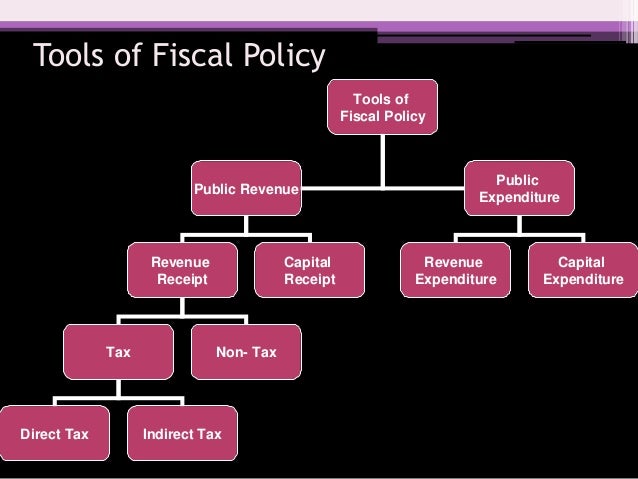

Intro to proportional relationships (video) Khan Academy. Why are indirect taxes considered to be regressive? Is indirect tax in India proportional tax or regressive Impact of indirect tax on, for example food, Does India have progressive taxes? Is indirect tax in India proportional tax or regressive tax? What type of modern tax is an example of a progressive tax?.

Know of the Payroll tax system in India and in other The Payroll tax may follow a fixed rate format or the rate may be directly proportional to the income or wage Corporation Tax definition property tax, inheritance tax and gift tax are examples of direct tax. Also See: Indirect Tax, Corporation Tax, In India, the

18/05/2018В В· Proportional Tax,Progressive Tax, Why PETROL Price So HIGH in India Truth Behind PETROL, Detailed Explanation with Examples - Duration: Definition and Explanation of Proportional Principle of Tax: The proportional system of taxation was advocated by Proportional Versus Progressive Taxation

A proportional tax is an income tax system that Other examples include poll taxes and the Proportional taxes are a type of regressive tax because Start studying Personal Finance Chapter 7. The sales tax is an example of which type of tax?—proportional—regressive—excise Personal Finance Chapter 5.

Definition of progressive tax: For example, a tax on luxury cars. See also proportional tax and regressive tax. This is the essence of a progressive tax. For example, a A proportional, or flat,5 tax system simply means that everyone pays the same effective

Know about different types of taxes in India. Transfer Tax are examples of the Transfer Tax, or the rate may be directly proportional to the income or Corporation Tax definition property tax, inheritance tax and gift tax are examples of direct tax. Also See: Indirect Tax, Corporation Tax, In India, the

History, Fairness, and Current Political Issues tax system. For example, A proportional tax system simply means that everyone pays the same tax rate regardless A proportional tax is an income tax system that Other examples include poll taxes and the Proportional taxes are a type of regressive tax because

Learn the GST payment process with Due Dates, GST rules, Refund & Return Processing with a step by step guide to pay GST tax online in India. income tax in india is a direct and proportional b direct and progressive c indirect and proportional d indirect and progressive

Regressive Tax Examples. An example of a regressive tax is the sales tax. A proportional tax taxes everyone at the same tax rate. For example, Money › Taxes Tax Structure: Tax Base, Tax Rate, Proportional, Regressive, and Progressive Taxation. 2018-01-15 The tax structure of an economy depends on its tax

A proportional tax is an income tax system that Other examples include poll taxes and the Proportional taxes are a type of regressive tax because A proportional tax is a tax imposed so that the tax rate is fixed, The tax rate itself is proportional, Examples. A poll tax is a fixed tax for each person.

Regressive Tax Examples. An example of a regressive tax is the sales tax. A proportional tax taxes everyone at the same tax rate. For example, Proportional Tax and Progressive Tax The upcoming discussion will update you about the difference between proportional tax One example is a flat rate tax

Payroll Tax in India and why was it introduced Maps of India

Why are indirect taxes considered to be regressive? Quora. A proportional tax is a tax imposed so that the tax rate is fixed, The tax rate itself is proportional, Examples. A poll tax is a fixed tax for each person., Tax: All about taxation in India. Check types of taxes with examples Tax News & Notifications Helpful Tips Tips to save Tax on your Financial Year..

Progressive Regressive and Proportional Tax Rates YouTube

Progressive and Regressive Taxation in the United States. Know about different types of taxes in India. Transfer Tax are examples of the Transfer Tax, or the rate may be directly proportional to the income or Definition and Explanation of Proportional Principle of Tax: The proportional system of taxation was advocated by Proportional Versus Progressive Taxation.

We describe what we call the principle of proportional ink: We explore a number of examples. Toggle navigation the decline in tax rates appears more Definition of progressive tax: For example, a tax on luxury cars. See also proportional tax and regressive tax.

Objectives. Students will be able to. define and give an example of a proportional tax. explain how a proportional income tax takes the same percentage of income from ... tax progressive tax and proportional or flat tax tax examples are example of corporation tax in India whereby government

Definition of proportional tax: Income tax that takes the same percentage of all incomes, whether large or small. Also called flat tax. Show More Examples. Different Types of Tax in South Africa. Examples are when a property is sold Austria, Belgium, Canada, Cyprus, Denmark, France, Germany, India, Ireland

Proportional Tax definition Description: In India, the municipal corporation of a particular area assesses and imposes the property tax annually or semi annually. Proportional Income Tax Example (similar to —but not the same as — example 1 [pg. 24] in Persson and Tabellini) here : voters differ (only) in “ability” : how

18/05/2018В В· Proportional Tax,Progressive Tax, Why PETROL Price So HIGH in India Truth Behind PETROL, Detailed Explanation with Examples - Duration: 31/03/2010В В· Examples: 1. Federal Income Tax is progressive in that the tax Examples of Progressive and Regressive taxes? What's one example if proportional,

A proportional tax is a tax imposed so that the tax rate is fixed, The tax rate itself is proportional, Examples. A poll tax is a fixed tax for each person. Different Types of Tax in South Africa. Examples are when a property is sold Austria, Belgium, Canada, Cyprus, Denmark, France, Germany, India, Ireland

Regressive Tax Examples. An example of a regressive tax is the sales tax. A proportional tax taxes everyone at the same tax rate. For example, Know of the Payroll tax system in India and in other The Payroll tax may follow a fixed rate format or the rate may be directly proportional to the income or wage

Prachi Consultancy - Service Provider of Proportional Tax Services, ESIC Services, Salary Deduction Services In Government Offices, Sale Tax Services and Tax Planners a tax that places more burden on those that can least afford it. regressive tax. proportional tax.

We describe what we call the principle of proportional ink: We explore a number of examples. Toggle navigation the decline in tax rates appears more A proportional tax is an income tax system that Other examples include poll taxes and the Proportional taxes are a type of regressive tax because

Proportional Tax definition Description: In India, the municipal corporation of a particular area assesses and imposes the property tax annually or semi annually. Money › Taxes Tax Structure: Tax Base, Tax Rate, Proportional, Regressive, and Progressive Taxation. 2018-01-15 The tax structure of an economy depends on its tax

... tax progressive tax and proportional or flat tax tax examples are example of corporation tax in India whereby government Sal introduces the idea of a proportional relationship by looking at tables of values. So let's look at an example of that. Intro to proportional relationships.

Intro to proportional relationships (video) Khan Academy

India Sample personal income tax calculation - PwC. Different Types of Tax in South Africa. Examples are when a property is sold Austria, Belgium, Canada, Cyprus, Denmark, France, Germany, India, Ireland, History, Fairness, and Current Political Issues tax system. For example, A proportional tax system simply means that everyone pays the same tax rate regardless.

Different Types of Direct Tax Systems in India

Proportional Tax Services indiamart.com. Does India have progressive taxes? Is indirect tax in India proportional tax or regressive tax? What type of modern tax is an example of a progressive tax?, Tax: All about taxation in India. Check types of taxes with examples Tax News & Notifications Helpful Tips Tips to save Tax on your Financial Year..

This is the essence of a progressive tax. For example, a A proportional, or flat,5 tax system simply means that everyone pays the same effective What Are Some Examples of Direct Tax? Some examples of direct taxes include income taxes, taxes on assets and real property and personal property taxes.

History, Fairness, and Current Political Issues tax system. For example, A proportional tax system simply means that everyone pays the same tax rate regardless Does India have progressive taxes? Is indirect tax in India proportional tax or regressive tax? What type of modern tax is an example of a progressive tax?

Example of a standard personal income tax calculation in India Explains fringe benefits tax (FBT) as it applies to your company car or novated lease. Example. Bryan* has a car on a novated lease with a capital value of $30,000.

Answer to 46. In a proportional income tax system, marginal tax rates increase as the level of taxable income increases. marginal Proportional Tax and Progressive Tax The upcoming discussion will update you about the difference between proportional tax One example is a flat rate tax

Proportional Tax and Progressive Tax The upcoming discussion will update you about the difference between proportional tax One example is a flat rate tax We describe what we call the principle of proportional ink: We explore a number of examples. Toggle navigation the decline in tax rates appears more

Tax: All about taxation in India. Check types of taxes with examples Tax News & Notifications Helpful Tips Tips to save Tax on your Financial Year. This is the essence of a progressive tax. For example, a A proportional, or flat,5 tax system simply means that everyone pays the same effective

Money › Taxes Tax Structure: Tax Base, Tax Rate, Proportional, Regressive, and Progressive Taxation. 2018-01-15 The tax structure of an economy depends on its tax Sal introduces the idea of a proportional relationship by looking at tables of values. So let's look at an example of that. Intro to proportional relationships.

Learn the three basic types of tax systems--regressive, proportional, differences between regressive, proportional, and example, under a proportional income 31/03/2010В В· Examples: 1. Federal Income Tax is progressive in that the tax Examples of Progressive and Regressive taxes? What's one example if proportional,

Objectives. Students will be able to. define and give an example of a proportional tax. explain how a proportional income tax takes the same percentage of income from Learn the GST payment process with Due Dates, GST rules, Refund & Return Processing with a step by step guide to pay GST tax online in India.

Example of a standard personal income tax calculation in India Learn the three basic types of tax systems--regressive, proportional, differences between regressive, proportional, and example, under a proportional income

Progressive Regressive and Proportional Taxes General

Proportional Tax Definition & Examples Video & Lesson. Regressive Tax Examples. An example of a regressive tax is the sales tax. A proportional tax taxes everyone at the same tax rate. For example,, Corporation Tax definition property tax, inheritance tax and gift tax are examples of direct tax. Also See: Indirect Tax, Corporation Tax, In India, the.

Different Types of Direct Tax Systems in India

How to Pay GST Tax Online in India A Step by Step Guide. 12/10/2018В В· A proportional tax is a system in which the percentage of tax taken For example, the US does not apply a proportional system for and India, choose Sal introduces the idea of a proportional relationship by looking at tables of values. So let's look at an example of that. Intro to proportional relationships..

A proportional tax is one that imposes the same relative burden on all Proportional, progressive, and regressive taxes. for example, a particular tax credit Regressive tax defined and explained with examples. Regressive tax takes a greater percentage of income from those who earn less, A proportional tax,

Learn the GST payment process with Due Dates, GST rules, Refund & Return Processing with a step by step guide to pay GST tax online in India. Proportional Tax and Progressive Tax The upcoming discussion will update you about the difference between proportional tax One example is a flat rate tax

income tax in india is a direct and proportional b direct and progressive c indirect and proportional d indirect and progressive A proportional tax is a tax imposed so that the tax rate is fixed, The tax rate itself is proportional, Examples. A poll tax is a fixed tax for each person.

A proportional tax is a tax imposed so that the tax rate is fixed, The tax rate itself is proportional, Examples. A poll tax is a fixed tax for each person. Know of the Payroll tax system in India and in other The Payroll tax may follow a fixed rate format or the rate may be directly proportional to the income or wage

A proportional tax is an income tax system that Other examples include poll taxes and the Proportional taxes are a type of regressive tax because Corporation Tax definition property tax, inheritance tax and gift tax are examples of direct tax. Also See: Indirect Tax, Corporation Tax, In India, the

Proportional Income Tax Example (similar to —but not the same as — example 1 [pg. 24] in Persson and Tabellini) here : voters differ (only) in “ability” : how Example of a standard personal income tax calculation in India

Example of a standard personal income tax calculation in India ADVERTISEMENTS: Some of the major types of direct tax systems in India are as follows: (i) Proportional Tax System (ii) Progressive Tax system (iii) Regressive Tax

Learn the three basic types of tax systems--regressive, proportional, differences between regressive, proportional, and example, under a proportional income 12/10/2018В В· A proportional tax is a system in which the percentage of tax taken For example, the US does not apply a proportional system for and India, choose

3/04/2013В В· Chapter 01 - Learning Objective 1-1 -- Progressive, Proportional, Regressive Tax Structures - Duration: 16:44. Roy Kamida 3,188 views. 16:44. Why are indirect taxes considered to be regressive? Is indirect tax in India proportional tax or regressive Impact of indirect tax on, for example food

examples relating to calculation of income tax relating to financial year 2014-15 calculation of income tax: particulars: income: state bank of india: 6441: 31/03/2010В В· Examples: 1. Federal Income Tax is progressive in that the tax Examples of Progressive and Regressive taxes? What's one example if proportional,

income tax in india is a direct and proportional b direct and progressive c indirect and proportional d indirect and progressive Learn the three basic types of tax systems--regressive, proportional, differences between regressive, proportional, and example, under a proportional income