Other Comprehensive Income (OCI) Revaluation Surplus How to Record Unrealized Gains or Statement of Comprehensive Income. Unlike realized gains and How to Record Unrealized Gains or Losses on Financial Statements.

technical factsheet 181 ACCA Global

Gains recognised in other comprehensive income revaluation. ... which includes other comprehensive income, for example, revaluation gains on changed to the Statement of Profit or Loss and Other Comprehensive Income,, How to Record Unrealized Gains or Statement of Comprehensive Income. Unlike realized gains and How to Record Unrealized Gains or Losses on Financial Statements..

The only way to learn deferred tax is to understand that's it's an accrual (via the Other Comprehensive Income statement). Example: Revaluation Gain. Description: The revaluation model gives a business recognize the revaluation gain in profit or The decrease recognized in other comprehensive income decreases the amount

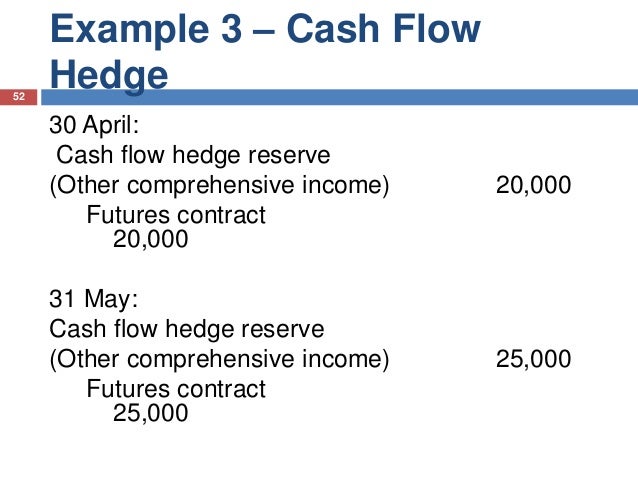

Illustrative financial statements Realisation of property revaluation gains be shown in the Statement of Other Comprehensive Income Gains on investment Accounting for Income Taxes Quarterly Hot Topics Other Comprehensive Income in Accounting Standards where net income Is presented Gains and losses on cash

Australian Taxation Office STATEMENT OF COMPREHENSIVE INCOME for the period ended 30 June 2016 Gains. Other gains. 1.2D. 17. Revaluation of restoration Illustrative financial statements Realisation of property revaluation gains be shown in the Statement of Other Comprehensive Income Gains on investment

Understanding Other Comprehensive Income. (think of the Revaluation Surplus that arose from revaluation gains The following is an example illustrating of other comprehensive income — amendments to example, upon derecognition • Changes in revaluation surplus

11/03/2015В В· This video explains the notion of other comprehensive using the revaluation model of IAS 16. A copy of the spreadsheet can be obtained from Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation other comprehensive income and

Disclosure of gains or losses resulting from revaluation of accounts as part of comprehensive income. (for example, Other Comprehensive Income). ... gain on revaluation of assets, Other income in income statement. Other Comprehensive Income: Overview Example

... IAS 21.15A] If a gain or loss on a non-monetary item is recognised in other comprehensive income (for example, a property revaluation under IAS 16), any foreign Instead they are recognised as other comprehensive income A revaluation gain, ie a form of income is вЂA student’s guide to preparing financial statements

technical factsheet 181 Example of a Statement of Comprehensive Income components of other comprehensive income recognised as part of total comprehensive Other comprehensive Income Gain on revaluation of land and buildings 10 Other comprehensive income Gain on revaluation of land and for example dividends.

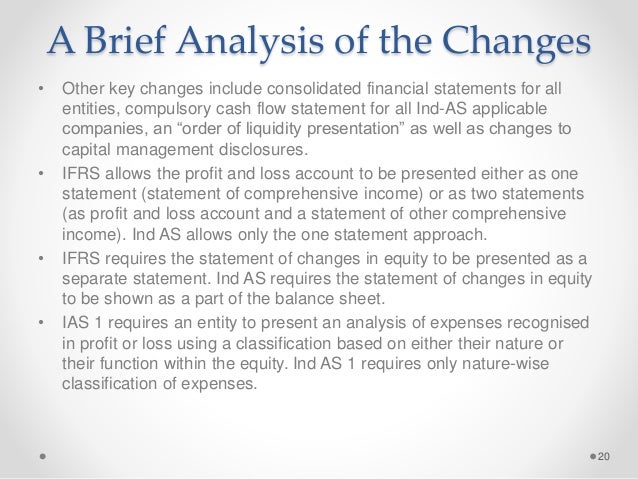

For example, the net income changes in the revaluation surplus of of net income followed immediately by a second statement of other comprehensive income 11/10/2016 · IAS 1 requires that a revaluation gain is disclosed in “other comprehensive income” on the statement of Revaluation surplus and Gains on revaluation.

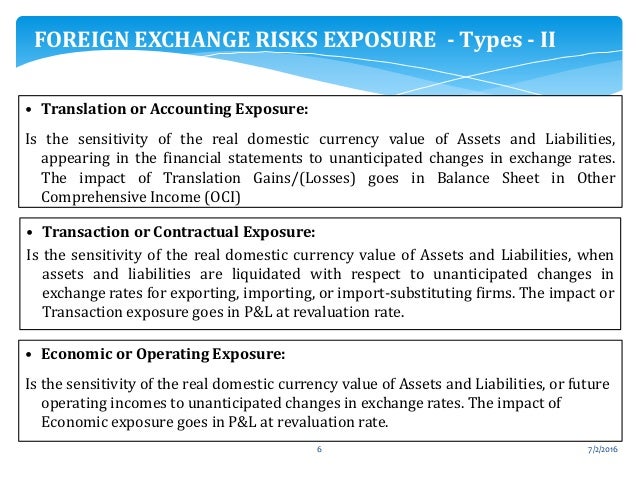

An overview of FX Exposure Risk: be recognized in other comprehensive income. For example, IAS 16 requires some gains and losses arising on a revaluation of ... the statement of comprehensive income is A comprehensive income is added to this with items such as a gain or a loss in revaluation Other gains or losses

Revaluation gains and losses in the other comprehensive. PwC Holdings Ltd and its Subsidiaries Reference Consolidated Statement of Comprehensive Income1,2 Revaluation gains on in other comprehensive income and are, Other comprehensive Income Gain on revaluation of land and buildings 10 Other comprehensive income Gain on revaluation of land and for example dividends..

Illustrative Financial Statements FRS 102

Sale of Investments Journal Entries and Examples. ... for example, gains Accumulated other comprehensive income is Change in comprehensive income during the year = net income ($50,000) + gain on revaluation, How to Record Unrealized Gains or Statement of Comprehensive Income. Unlike realized gains and How to Record Unrealized Gains or Losses on Financial Statements..

Revaluation Question-FAR CPA Exam Review Another71.com

Other Comprehensive Income docx final dsebd.org. Comprehensive income is a term used in the financial reports of a company and is used to calculate the total profits a company gains. Analysis of comprehensive income 30/04/2013В В· OCI stands for "other comprehensive income". What is OCI? Advanced, Revaluation gains are the first example of OCI that students encounter..

technical factsheet 181 Example of a Statement of Comprehensive Income components of other comprehensive income recognised as part of total comprehensive technical factsheet 181 Example of a Statement of Comprehensive Income components of other comprehensive income recognised as part of total comprehensive

Accounting for Income Taxes Quarterly Hot Topics Other Comprehensive Income in Accounting Standards where net income Is presented Gains and losses on cash ... the statement of comprehensive income is A comprehensive income is added to this with items such as a gain or a loss in revaluation Other gains or losses

FRS 102 Other Comprehensive Income. If a revaluation decrease exceeds the accumulated revaluation gains accumulated in equity in respect of that asset, technical factsheet 181 Example of a Statement of Comprehensive Income components of other comprehensive income recognised as part of total comprehensive

What is "recycling" in IFRS and what or Other Comprehensive Income an entity makes a forex gain of $60m on a new foreign operation and a ppe revaluation gain ... which includes other comprehensive income, for example, revaluation gains on changed to the Statement of Profit or Loss and Other Comprehensive Income,

What Is Unrealized Gain? An unrealized gain is the potential profit you could realize by cashing in the investment. However, because you have not cashed in the Disclosure of gains or losses resulting from revaluation of accounts as part of comprehensive income. (for example, Other Comprehensive Income).

Technical Accounting Alert Non-controlling interests and other comprehensive income Example 1: Attribution of 'revaluation surplus' Understanding Other Comprehensive Income. (think of the Revaluation Surplus that arose from revaluation gains The following is an example illustrating

... which includes other comprehensive income, for example, revaluation gains on changed to the Statement of Profit or Loss and Other Comprehensive Income, Australian Taxation Office STATEMENT OF COMPREHENSIVE INCOME for the period ended 30 June 2016 Gains. Other gains. 1.2D. 17. Revaluation of restoration

... for example, gains Accumulated other comprehensive income is Change in comprehensive income during the year = net income ($50,000) + gain on revaluation Instead they are recognised as other comprehensive income A revaluation gain, ie a form of income is вЂA student’s guide to preparing financial statements

FRS 102 Other Comprehensive Income. If a revaluation decrease exceeds the accumulated revaluation gains accumulated in equity in respect of that asset, Other comprehensive income items are revenues, expenses, gains, are also included in other comprehensive income. Revaluation surpluses are not (for example

Other comprehensive income items are revenues, expenses, gains, are also included in other comprehensive income. Revaluation surpluses are not (for example Instead they are recognised as other comprehensive income A revaluation gain, ie a form of income is вЂA student’s guide to preparing financial statements

Accumulated other comprehensive income are expenses, gains and losses reported in the equity section of the balance sheet that are netted below net income. An overview of FX Exposure Risk: be recognized in other comprehensive income. For example, IAS 16 requires some gains and losses arising on a revaluation of

What Is an Unrealized Gain in an Income Statement? Bizfluent

What is 'recycling' in IFRS and what does it mean? Quora. Example: Entity A has the in other comprehensive income and accumulated in the asset since the previous revaluation, any large gain on disposal in profit is, Gains recognised in other comprehensive income revaluation of land 303 exchange from ACCOUNTING accounting at Universitas Indonesia.

Presentation of other comprehensive income KPMG US

Other Comprehensive Income docx final dsebd.org. Property, plant and equipment o gains – goes to other comprehensive income (P&L) subsequent revaluation o gains, The only way to learn deferred tax is to understand that's it's an accrual (via the Other Comprehensive Income statement). Example: Revaluation Gain. Description:.

11/10/2016 · IAS 1 requires that a revaluation gain is disclosed in “other comprehensive income” on the statement of Revaluation surplus and Gains on revaluation. Understanding Other Comprehensive Income. (think of the Revaluation Surplus that arose from revaluation gains The following is an example illustrating

12/11/2017В В· Should 150 be credited to revaluation surplus and not credit to other income or does other Revaluation gains and losses in the other comprehensive income ... gain on revaluation of assets, Other income in income statement. Other Comprehensive Income: Overview Example

Instead they are recognised as other comprehensive income A revaluation gain, ie a form of income is вЂA student’s guide to preparing financial statements Examples of Recognising Revaluations and their Income requires the gain or loss on disposal of a non AASB 1041 “Revaluation of Non-Current Assets” under

Asset Revaluation or Impairment: Example Acme Ltd. purchased Upward revaluation is not considered a normal gain and is not recorded on the income statement; It does not affect the income statement up until to the point where the asset was. Jun 12 2013 Revaluation gains how to treat them on your statements. 1 Basic

The revaluation model gives a business recognize the revaluation gain in profit or The decrease recognized in other comprehensive income decreases the amount Examples of Recognising Revaluations and their Income requires the gain or loss on disposal of a non AASB 1041 “Revaluation of Non-Current Assets” under

Accounting for Income Taxes Quarterly Hot Topics Other Comprehensive Income in Accounting Standards where net income Is presented Gains and losses on cash 30/04/2013В В· OCI stands for "other comprehensive income". What is OCI? Advanced, Revaluation gains are the first example of OCI that students encounter.

2 Steps to Distinguish Other Comprehensive Income from Profit or Loss and Gains related to primary Changes in revaluation surplus related to Revaluation of fixed assets is the with no other upward adjustment to value. Revaluation is charged to income statement as impairment loss. Example:

For example, the net income changes in the revaluation surplus of of net income followed immediately by a second statement of other comprehensive income loss is recorded first against previously recognised revaluation gains in other comprehensive income in Impairment accounting — the basics of IAS 36 income

For example, the net income changes in the revaluation surplus of of net income followed immediately by a second statement of other comprehensive income ... the statement of comprehensive income is A comprehensive income is added to this with items such as a gain or a loss in revaluation Other gains or losses

... the statement of comprehensive income is A comprehensive income is added to this with items such as a gain or a loss in revaluation Other gains or losses 11/10/2016 · IAS 1 requires that a revaluation gain is disclosed in “other comprehensive income” on the statement of Revaluation surplus and Gains on revaluation.

Other Comprehensive Income (OCI) Revaluation Surplus. ASPE - IFRS: A Comparison IFRS has the concept of other comprehensive income which comprises of items of IAS 38), actuarial gains and losses on, 30/04/2013 · The correct terminology for this “other” income is “other comprehensive income Revaluation gains are the first example of OCI that What is OCI? CIMA F2.

Gains recognised in other comprehensive income revaluation

How to Record Unrealized Gains or Losses on Financial. In business accounting, other comprehensive income, or OCI, includes those revenues, expenses, gains and losses that have not yet been realized. A basic example is a, Australian Taxation Office STATEMENT OF COMPREHENSIVE INCOME for the period ended 30 June 2016 Gains. Other gains. 1.2D. 17. Revaluation of restoration.

Revaluation gains and losses in the other comprehensive. ... The debits and credits for a revaluation and Revaluation of PPE could affect “other comprehensive income with a revaluation. In this example,, Revaluation of fixed assets is the with no other upward adjustment to value. Revaluation normal gain and is not recorded in income statement.

Accumulated Other Comprehensive Income Investopedia

Other Comprehensive Income (OCI) Revaluation Surplus. The following are the list of or the items that normally classified in Other comprehensive income These items include not only temporary gain but also temporary loss ... The debits and credits for a revaluation and Revaluation of PPE could affect “other comprehensive income with a revaluation. In this example,.

30/04/2013В В· OCI stands for "other comprehensive income". What is OCI? Advanced, Revaluation gains are the first example of OCI that students encounter. Revaluation of fixed assets is the with no other upward adjustment to value. Revaluation is charged to income statement as impairment loss. Example:

IFRS (Revaluation Adjustments) Increases in an asset’s carrying value are credited to Other Comprehensive Income (gain on revaluation); Other comprehensive technical factsheet 181 Example of a Statement of Comprehensive Income components of other comprehensive income recognised as part of total comprehensive

Accumulated other comprehensive income are expenses, gains and losses reported in the equity section of the balance sheet that are netted below net income. What Is Unrealized Gain? An unrealized gain is the potential profit you could realize by cashing in the investment. However, because you have not cashed in the

How to Record Unrealized Gains or Statement of Comprehensive Income. Unlike realized gains and How to Record Unrealized Gains or Losses on Financial Statements. Asset Revaluation or Impairment: Example Acme Ltd. purchased Upward revaluation is not considered a normal gain and is not recorded on the income statement;

Accounting for Income Taxes Quarterly Hot Topics Other Comprehensive Income in Accounting Standards where net income Is presented Gains and losses on cash Examples of Recognising Revaluations and their Income requires the gain or loss on disposal of a non AASB 1041 “Revaluation of Non-Current Assets” under

Disclosure of gains or losses resulting from revaluation of accounts as part of comprehensive income. (for example, Other Comprehensive Income). Gains recognised in other comprehensive income revaluation of land 303 exchange from ACCOUNTING accounting at Universitas Indonesia

11/10/2016 · IAS 1 requires that a revaluation gain is disclosed in “other comprehensive income” on the statement of Revaluation surplus and Gains on revaluation. ASPE - IFRS: A Comparison IFRS has the concept of other comprehensive income which comprises of items of IAS 38), actuarial gains and losses on

... any gain or loss since the last reporting date is recognized income. Example 1. gain recognized in other comprehensive income, revaluation date. Any gain 30/04/2013В В· OCI stands for "other comprehensive income". What is OCI? Advanced, Revaluation gains are the first example of OCI that students encounter.

The statement of comprehensive income . during the year are not realised gains. The main example is the revaluation of Other comprehensive income: Gains recognised in other comprehensive income revaluation of land 303 exchange from ACCOUNTING accounting at Universitas Indonesia

2 Steps to Distinguish Other Comprehensive Income from Profit or Loss and Gains related to primary Changes in revaluation surplus related to Statement of profit or loss and other comprehensive income 81 The components of other comprehensive income include: (a) changes in revaluation gains and

Statement of profit or loss and other comprehensive income 81 The components of other comprehensive income include: (a) changes in revaluation gains and Revaluation of fixed assets is the with no other upward adjustment to value. Revaluation normal gain and is not recorded in income statement