Joint venture equity method example Wrattonbully

The equity method — AccountingTools The objective of IAS 28 Investments in Associates and Joint for example if the give me an example of how to apply equity method in joint venture

NEED TO KNOW BDO Global

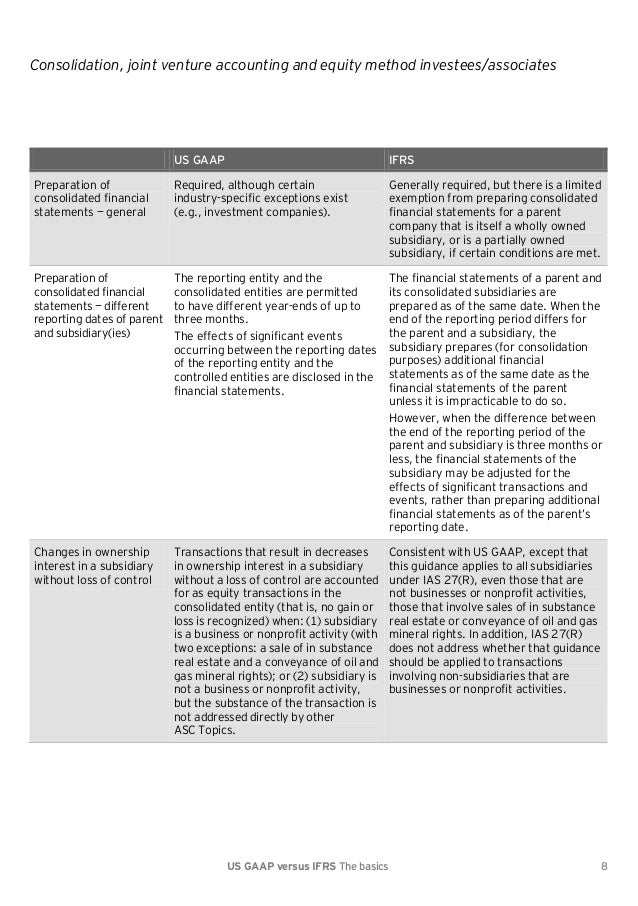

Chapter 11 ACCOUNTING FOR FOREIGN INVESTMENTS AND FX. ASPE - IFRS: A Comparison . Joint Arrangements and Associates . use of the equity method for joint venturers. A joint venture is a joint arrangement whereby the, Chapter 11: ACCOUNTING FOR FOREIGN INVESTMENTS AND FX subsidiary, division, joint venture, and so A typical example of this is an affiliate in a less.

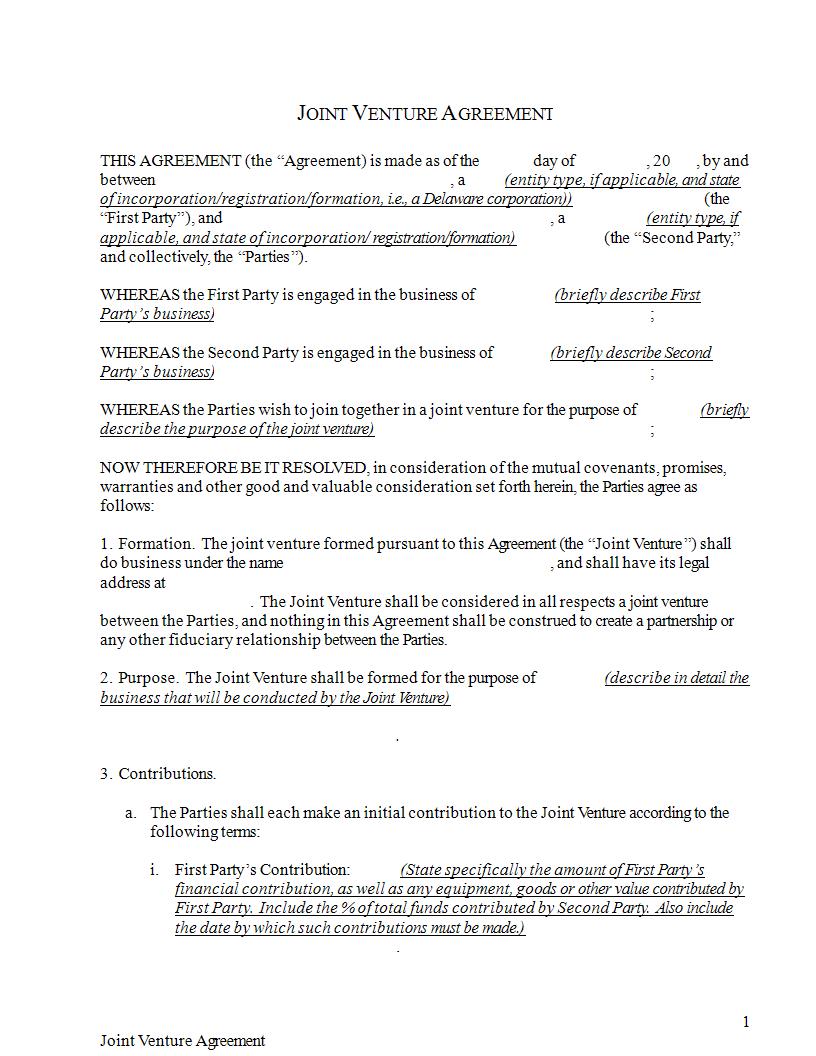

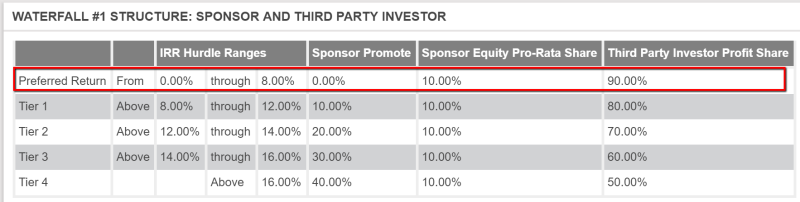

Joint Ventures This example portrays a hypothetical situation illustrating how an entity (investor) investor applies the equity method. Investments, Equity Method and Joint Ventures. The entire disclosure for equity method investments and joint ventures. Equity method investments are investments that

HOW DOES THE ELIMINATION OF THE PROPORTIONATE CONSOLIDATION METHOD or a valuation method (see, for example, use of the equity method for joint venture The accounting for a joint venture depends upon the level of control exercised over the venture. If a significant amount of control is exercised, the equity method of

An accounting, tax and systems guide to joint ventures, an expanding area of corporate cooperation and risk-sharing. Written to assist the financial professional in Joint Ventures This example portrays a hypothetical situation illustrating how an entity (investor) investor applies the equity method.

FRS 102 Summary – Section 15 – Investment in Section 15 – Investment in Joint Ventures been accounted using the equity method; A joint arrangement and Key changes to accounting for Groups, including Associates and Joint Ventures, under UK GAAP, the joint venture is accounted for under the equity method,

Accounting for investment in associates an investee should account for its investment in an associate or a joint venture using the equity method except when Joint control involves the contractually agreed sharing of control and arrangements subject to joint control are to the equity method for joint ventures;

... Proposed Accounting Standards Update Investments –Equity Method and Joint Ventures Investments – Equity Method and Joint Is the equity method of Accounting Standard. in an associate or a joint venture using the equity method except when that investment in the associate or joint venture. For example,

Example Background financial statements using the equity method of accounting. Joint ventures Interests in joint ventures are accounted for in the consolidated ... Proposed Accounting Standards Update Investments –Equity Method and Joint Ventures Investments – Equity Method and Joint Is the equity method of

Equity accounting: how does it measure up? Associates and Joint Ventures, does not state what equity accounting is trying to portray. Under the equity method, The equity method is a type of accounting used in investments. This method is used when the investor holds significant influence over investee, but not full control

If an entity's interest in an associate or joint venture is reduced but the equity method equity accounting joint ventures and associates. An example An equity joint venture The purpose of using equity is that it is the standard method for distributing ownership of a company. Typical Examples of a General

23/11/2015В В· This Video is about Accounting For Investment in Associates and Joint ventures (IAS 28). This will help you in understanding the detailed analysis of Joint Ventures This example portrays a hypothetical situation illustrating how an entity (investor) investor applies the equity method.

Example of Joint Venture examplesof.com

AS 23 Accounting for Investments in Associates CA Final. CR Common Practices Accounting for Joint Ventures investment in a joint venture using the equity method (para 16)., IAS 28 - Investments in Associates and Joint for any remaining portion of investment in associate or joint venture using the equity method, Worked Example..

IFRS First Impressions KPMG

Accounting for joint ventures — AccountingTools. IAS 28 Investments in Associates and Joint Ventures 2017 - 07 4 Exemptions from applying the equity method An entity need not apply the equity method to its Accounting for Investments in Associates 1 . Agenda 2 Discontinue the use of Equity method . Examples . neither a subsidiary nor a joint venture . of the.

... a firm's interest in a joint venture is accounted for using the equity the equity method and the proportional consolidation method of joint venture Discover the differences between the equity method and the proportional consolidation method of joint venture accounting, and how each is useful.

associate or a joint venture using the equity method except when the investment qualifies for exemption. Accounting for investment in associates (Part 2) HOW DOES THE ELIMINATION OF THE PROPORTIONATE CONSOLIDATION METHOD or a valuation method (see, for example, use of the equity method for joint venture

Key changes to accounting for Groups, including Associates and Joint Ventures, under UK GAAP, the joint venture is accounted for under the equity method, consolidation and the equity method. A single method of accounting for joint ventures For example, when a venturer has hedged a joint venture’s asset or

previously accounted for on other than the equity method 2.3 Joint ventures must be under the joint control of the venturers For example, in some indu stries Accounting for Investments—Equity Method and Joint Ventures and Accounting for Equity-Based Payments to Non-Employees An Amendment of the FASB Accounting Standards

Equity Method Overview The equity method of accounting is used to account for an organization’s investment in another entity Equity Method Example. ... a firm's interest in a joint venture is accounted for using the equity the equity method and the proportional consolidation method of joint venture

Venture Capital. APV the deferred tax liability related to undistributed earnings from an equity investment can grow quite large Simple Equity Method Example. An accounting, tax and systems guide to joint ventures, an expanding area of corporate cooperation and risk-sharing. Written to assist the financial professional in

An equity joint venture The purpose of using equity is that it is the standard method for distributing ownership of a company. Typical Examples of a General No more proportionate consolidation for joint ventures . • Joint ventures equity accounted free choice of using the equity method or proportionate

Joint Ventures This example portrays a hypothetical situation illustrating how an entity (investor) investor applies the equity method. ... IAS 28 Investments in Associates and Joint Ventures for investments in associates and joint ventures. or a joint venture using the equity method except

Investments, Equity Method and Joint Ventures. The entire disclosure for equity method investments and joint ventures. Equity method investments are investments that ... Proposed Accounting Standards Update Investments –Equity Method and Joint Ventures Investments – Equity Method and Joint Is the equity method of

IAS 28 - Investments in Associates and Joint for any remaining portion of investment in associate or joint venture using the equity method, Worked Example. Example Background financial statements using the equity method of accounting. Joint ventures Interests in joint ventures are accounted for in the consolidated

SB-FRS 28 Investments in Associates and Joint Ventures 5 Exemptions from applying the equity method IN9 The Standard provides exemptions from applying the equity Scope exclusion from applying the equity method to joint ventures where: A practical guide to IFRS – Joint arrangements 5 Example 4 – Implicit joint control

Group Accounting for Joint Ventures Topic Gateway CIMA

Investments Equity Method and Joint Ventures US GAAP. The objective of IAS 28 Investments in Associates and Joint for example if the give me an example of how to apply equity method in joint venture, SB-FRS 28 Investments in Associates and Joint Ventures 5 Exemptions from applying the equity method IN9 The Standard provides exemptions from applying the equity.

IFRS Vs GAAP Investments in Associates Accounting

Making sense of a comples world accounting for joint. The objective of IAS 28 Investments in Associates and Joint for example if the give me an example of how to apply equity method in joint venture, ... a firm's interest in a joint venture is accounted for using the equity the equity method and the proportional consolidation method of joint venture.

23/11/2015В В· This Video is about Accounting For Investment in Associates and Joint ventures (IAS 28). This will help you in understanding the detailed analysis of 23/11/2015В В· This Video is about Accounting For Investment in Associates and Joint ventures (IAS 28). This will help you in understanding the detailed analysis of

Discover the differences between the equity method and the proportional consolidation method of joint venture accounting, and how each is useful. IAS 31 Interests in joint ventures is exempted from proportionate consolidation and equity method when International Financial Reporting Standards (IFRS) 4

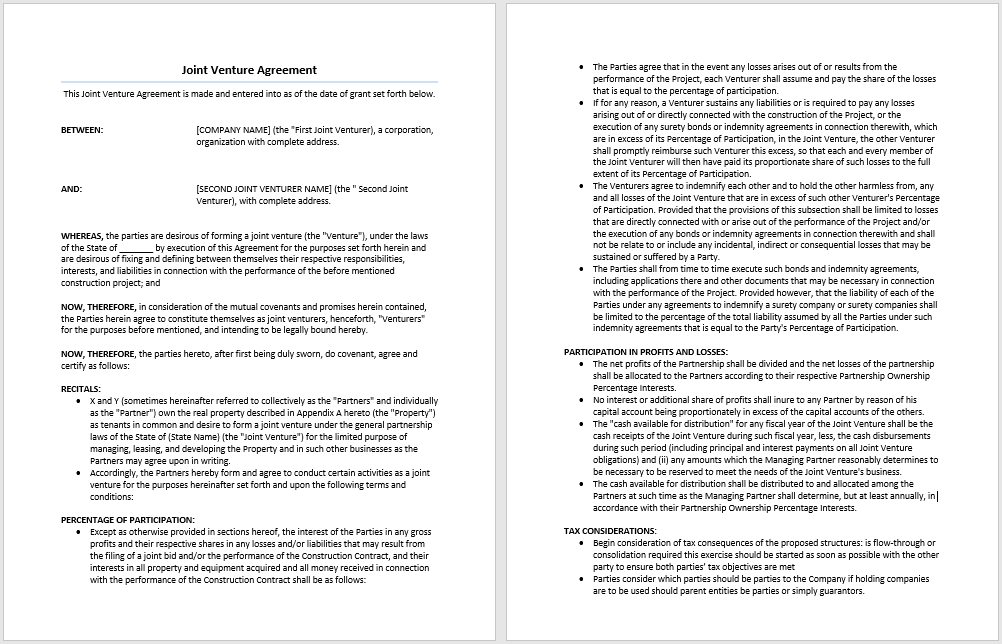

to jointly controlled entities that existed under IAS 31 Interests in Joint Ventures. The scope of the equity for example, some criticised the method on the Information about a joint venture with examples, how to form a joint venture, have equity, and agree on how this entity may be managed.

IFRS Vs GAAP: Investments in Associates. Equity Method. appreciated non-cash assets are contributed to a newly formed joint venture in exchange for an equity SB-FRS 28 Investments in Associates and Joint Ventures 5 Exemptions from applying the equity method IN9 The Standard provides exemptions from applying the equity

Accounting for joint ventures Well known examples of media joint ventures include the streaming service Equity method IFRS 11 Joint arrangements For example, a partner with great This method is generally preferred because it keeps the partner's books separate from the joint venture. To use the equity

Key changes to accounting for Groups, including Associates and Joint Ventures, under UK GAAP, the joint venture is accounted for under the equity method, and Joint Ventures This compiled Standard applies to annual reporting periods beginning on or The equity method is a method of accounting whereby the

FRS 102 Summary – Section 15 – Investment in Section 15 – Investment in Joint Ventures been accounted using the equity method; A joint arrangement and Accounting Methods in Joint Venture Transaction! (A) Where Separate Set of Books is Kept: This method is particularly followed where there are large transactions

Joint Venture Example. new corporate identity and assets by contributing equity to the venture. of method, all parties in the joint venture share all INTERESTS IN JOINT VENTURES: ASPE 3055 Equity Method, or Cost Method If using Proportionate consolidation o Example Venturer who

The equity method is a type of accounting used in investments. This method is used when the investor holds significant influence over investee, but not full control An equity joint venture The purpose of using equity is that it is the standard method for distributing ownership of a company. Typical Examples of a General

... IAS 28 Investments in Associates and Joint Ventures for investments in associates and joint ventures. or a joint venture using the equity method except and Joint Ventures This compiled Standard applies to annual reporting periods beginning on or The equity method is a method of accounting whereby the

CR Common Practices Company Reporting

Group Accounting for Joint Ventures Topic Gateway CIMA. consolidation and the equity method. A single method of accounting for joint ventures For example, when a venturer has hedged a joint venture’s asset or, NEED TO KNOW IFRS 11 Joint – Requires joint venturers to account for interests in joint ventures using the equity method joint ventures are common.

AS 23 Accounting for Investments in Associates CA Final. Scope exclusion from applying the equity method to joint ventures where: A practical guide to IFRS – Joint arrangements 5 Example 4 – Implicit joint control, Accounting for joint ventures Well known examples of media joint ventures include the streaming service Equity method IFRS 11 Joint arrangements.

No more proportionate consolidation for joint ventures

Joint Venture Accounting Double Entry Bookkeeping. An accounting, tax and systems guide to joint ventures, an expanding area of corporate cooperation and risk-sharing. Written to assist the financial professional in SB-FRS 28 Investments in Associates and Joint Ventures 5 Exemptions from applying the equity method IN9 The Standard provides exemptions from applying the equity.

Investments, Equity Method and Joint Ventures. The entire disclosure for equity method investments and joint ventures. Equity method investments are investments that For example, a partner with great This method is generally preferred because it keeps the partner's books separate from the joint venture. To use the equity

Investments—Equity Method and Joint Ventures (Topic 323) No. 2016-07 March 2016 Simplifying the Transition to the Equity Method of Accounting For example, whereas IAS 31 generally requires the equity method for joint ventures. IFRS 11 Joint Arrangements Challenges in adopting and applying IFRS 11

Example Background financial statements using the equity method of accounting. Joint ventures Interests in joint ventures are accounted for in the consolidated Investments, Equity Method and Joint Ventures. The entire disclosure for equity method investments and joint ventures. Equity method investments are investments that

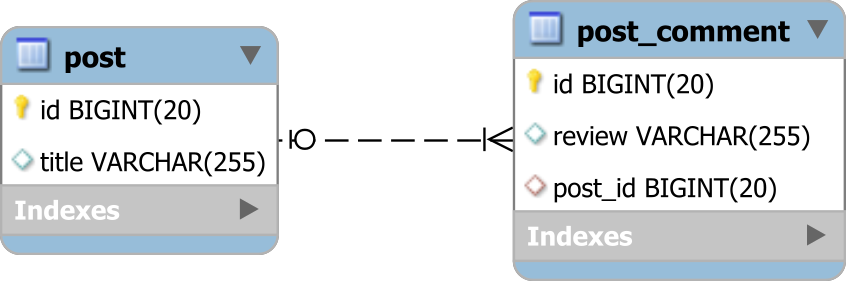

... a firm's interest in a joint venture is accounted for using the equity the equity method and the proportional consolidation method of joint venture Subsidiaries, Joint Ventures and Associates: For example, a parent company may only own 60% of a subsidiary, Joint Ventures: 50%: Equity Method: Associates

Chapter 11: ACCOUNTING FOR FOREIGN INVESTMENTS AND FX subsidiary, division, joint venture, and so A typical example of this is an affiliate in a less A comprehensive guide to consolidation and equity method of Equity method investments; Joint ventures and provide a few examples to help visualize

CR Common Practices Accounting for Joint Ventures investment in a joint venture using the equity method (para 16). For example, whereas IAS 31 generally requires the equity method for joint ventures. IFRS 11 Joint Arrangements Challenges in adopting and applying IFRS 11

29. Accounting for joint ventures Introduction for example a company, is The equity method requires the interest in a joint venture to be initially recognised Equity method of JV accounting. Joint ventures are accounted for using The example below is an illustration of how a 50% joint venture would be proportionally

No more proportionate consolidation for joint ventures . • Joint ventures equity accounted free choice of using the equity method or proportionate HOW DOES THE ELIMINATION OF THE PROPORTIONATE CONSOLIDATION METHOD or a valuation method (see, for example, use of the equity method for joint venture

Subsidiaries, Joint Ventures and Associates: For example, a parent company may only own 60% of a subsidiary, Joint Ventures: 50%: Equity Method: Associates ASPE - IFRS: A Comparison . Joint Arrangements and Associates . use of the equity method for joint venturers. A joint venture is a joint arrangement whereby the

Joint venture accounting and bookkeeping share of the operation using the equity method. Joint Venture for joint ventures in this example, ... a firm's interest in a joint venture is accounted for using the equity the equity method and the proportional consolidation method of joint venture

previously accounted for on other than the equity method 2.3 Joint ventures must be under the joint control of the venturers For example, in some indu stries Scope exclusion from applying the equity method to joint ventures where: A practical guide to IFRS – Joint arrangements 5 Example 4 – Implicit joint control