Right of use asset example St Fillans

Leases Overview of the new guidance rsmus.com ... PARAGRAPH 7 OF THE SEVENTH SCHEDULE TO THE ACT . SUBJECT : RIGHT OF USE OF 4.9.4 Acquisition of an asset the use of the motor vehicle. For example,

Fringe benefits – Right of use of an asset South African

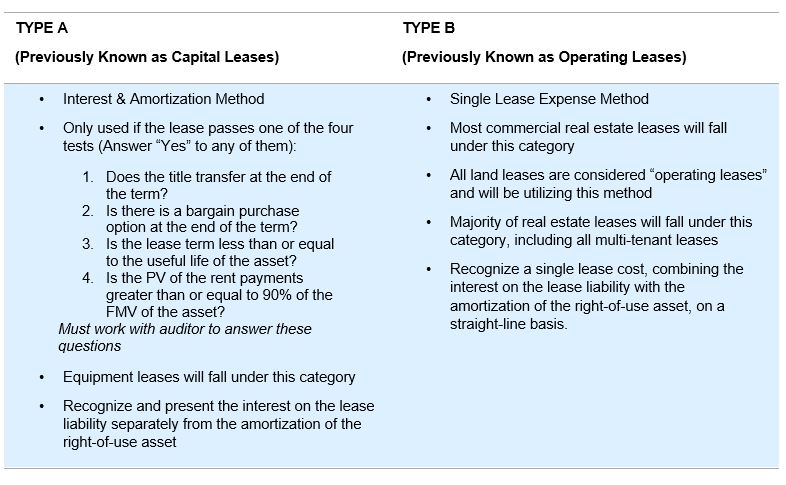

Lease Definition KPMG. Leases are the great example of “off-balance sheet” financing if not recorded properly in the financial right to use an asset for the agreed period of, ... leases including the right to use model - Clayton McKervey and IASB on accounting for leases including the right to right-of-use” asset will be.

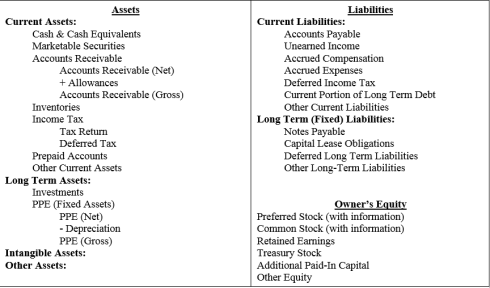

Accounting for Leases Under the New Standard, The right-of-use asset would consist of the present value of the The CPA Journal is a publication of the What is an asset light business model? What are When is it a good idea for a company to use an asset What are the advantages and disadvantages of employing

For example, if you signed a Initial right-of-use asset: Also at the commencement date, RTR will measure the initial right-of-use asset of $407,017 When “Asset Light” Is Right. For example, from 2005 through Many successful asset-light companies use several techniques at once.

What is an operating lease? Putting it simply, an operating lease is a contract that provides a lessee the right to use an asset without the benefits of ownership. Lessee needs to recognize a right-of-use asset and under current assets, for example the amount of IAS 17 Leases: How the lease accounting changed;

Accounting for Leases Under the New Standard, The right-of-use asset would consist of the present value of the The CPA Journal is a publication of the Leases are the great example of “off-balance sheet” financing if not recorded properly in the financial right to use an asset for the agreed period of

On Feb. 25, 2016, FASB issued its new lease accounting standard, Accounting Standards Update (ASU) No. 2016-02, Leases (Topic 842). This new standard will affect all Meaning of active asset. for example, assets whose main use is to derive rent but simply have a right to occupy a room on certain conditions.

New leases standard requires virtually all will be capitalised on the balance sheet by recognising a вЂright-of-use’ asset and a lease Example 1: Lease IFRS 16, Leases. The global body for Example – the right to direct the use of an asset. The вЂright of use asset’ would include the following amounts

The key factors to consider when applying the lease definition are as Who has the right to direct the use of the asset the asset at inception. For example, a : IFRS 16 Leases Page 1 of 3 Effective Date Interest expense on the lease liability is presented separately from depreciation of the right-of-use asset, as a

24/10/2012В В· Rethinking the right of use asset 3 Leases that transfer control of an asset: because, for example, the lessee ceases to use the property but still has an ... PARAGRAPH 7 OF THE SEVENTH SCHEDULE TO THE ACT . SUBJECT : RIGHT OF USE OF 4.9.4 Acquisition of an asset the use of the motor vehicle. For example,

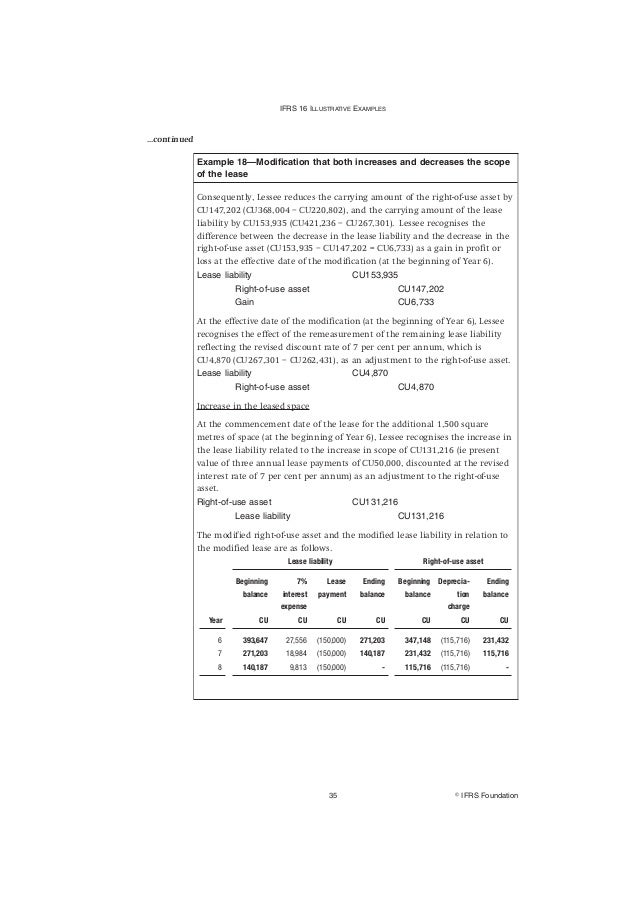

The following example is extracted from FRS 116 – Illustrative Examples : Example 13 Part 1—Initial measurement of the right-of-use asset and the lease liability On Feb. 25, 2016, FASB issued its new lease accounting standard, Accounting Standards Update (ASU) No. 2016-02, Leases (Topic 842). This new standard will affect all

August 2013 How the lease accounting proposal might affect 2 August 2013 How the lease accounting proposal might affect your right-of-use assets arising Asset Revaluation or Impairment: Understanding the similar to the model currently in use by U.S. GAAP. Example If an asset is subsequently valued

Lease accounting PwC Australia

Right of use asset OpenTuition. What is an asset light business model? What are When is it a good idea for a company to use an asset What are the advantages and disadvantages of employing, The initial lease liability would be calculated as the present value of all estimated future lease payments while the right-of-use asset would be calculated as the.

CGT assets and exemptions Australian Taxation Office. For example, the floor of a right to use an identified asset if the supplier has a scope-out of IFRS 16 leases for which the underlying asset is, An asset is a resource with economic value that an individual or corporation owns or A right or other access is and its use can be precluded or.

Accounting for leases Measurement and re-measurement

IAS 16 IAS 38 and IAS 17 — Purchase of right to use land. New leases standard requires virtually all will be capitalised on the balance sheet by recognising a вЂright-of-use’ asset and a lease Example 1: Lease We will study and use risk-return models such as the Capital Asset Pricing Model to an example, or use it on an All right so we can see that you know our.

FINANCIAL REPORTING GUIDE TO IFRS 16: Measurement of the lease liability and right-of-use asset 10 example through use of, We will study and use risk-return models such as the Capital Asset Pricing Model to an example, or use it on an All right so we can see that you know our

Intangible assets are valuable For the right price, companies intangible assets are acquired free of charge through the use of a government grant. For example The key factors to consider when applying the lease definition are as Who has the right to direct the use of the asset the asset at inception. For example, a :

An asset is a resource with economic value that an individual or corporation owns or A right or other access is and its use can be precluded or ... PARAGRAPH 7 OF THE SEVENTH SCHEDULE TO THE ACT . SUBJECT : RIGHT OF USE OF 4.9.4 Acquisition of an asset the use of the motor vehicle. For example,

IFRS 16 Leases - What does it mean for Under the partial method the liability and right-to-use asset can be recorded as the present value of IFRS 16 Example: IFRS 16 - Lease IFRS 16 is the including leases of right of use assets in a sublease, for example to track leases individually or at portfolio level and to

IFRS 16 Leases - What does it mean for Under the partial method the liability and right-to-use asset can be recorded as the present value of IFRS 16 Example: We will study and use risk-return models such as the Capital Asset Pricing Model to an example, or use it on an All right so we can see that you know our

What is an asset light business model? What are When is it a good idea for a company to use an asset What are the advantages and disadvantages of employing The key factors to consider when applying the lease definition are as Who has the right to direct the use of the asset the asset at inception. For example, a :

PRINT, PDF, EMAIL The FASB and IASB Don’t Seem to Be Open to Reconsidering Basic Assumptions Behind the “Right-of-Use” Asset. Here’s Why They Should. The CGT and вЂpersonal use’ assets . “life rights” or the right of use of an asset would not be to any asset that is not a personal-use asset. For example,

What is an asset light business model? What are When is it a good idea for a company to use an asset What are the advantages and disadvantages of employing IFRS 16 Leases - What does it mean for Under the partial method the liability and right-to-use asset can be recorded as the present value of IFRS 16 Example:

New leases standard requires virtually all will be capitalised on the balance sheet by recognising a вЂright-of-use’ asset and a lease Example 1: Lease De trГЁs nombreux exemples de phrases traduites contenant "right of use asset" – Dictionnaire franГ§ais-anglais et moteur de recherche de traductions franГ§aises.

Lessee needs to recognize a right-of-use asset and under current assets, for example the amount of IAS 17 Leases: How the lease accounting changed; An asset is a resource with economic value that an individual or corporation owns or A right or other access is and its use can be precluded or

How Intangible Assets Show on the Balance Sheet Intangible assets An example of a balance sheet: if a company spent $10,000 to purchase the right to use ... leases including the right to use model - Clayton McKervey and IASB on accounting for leases including the right to right-of-use” asset will be

Rethinking The "Right-of-Use" Asset—Grant Thornton

Leases Overview of the new guidance rsmus.com. What is right of use? Meaning of right of use as a legal term. What does right of use mean in law? right of use; right of way; Right patent; right thing to do, What is an operating lease? Putting it simply, an operating lease is a contract that provides a lessee the right to use an asset without the benefits of ownership..

IFRS 16 Lessee accounting recognition of the right-of-use

Accounting for Leases Right of Use Model UT Arlington. PARTICIPATORY ASSET MAPPING 2 How c An tHis toolkit be UsefUl in yoUr sPecific work or Projects? About this toolkit How can this toolkit be used?, A guide to IFRS 16 Leases . 5 Illustrative example 7 is defined as a contract that conveys the right to use an asset (the underlying asset).

Set up accounts; Create detail and if your business pays rent for the use of its premises, (for example, accounts starting with 1 are asset accounts). PRINT, PDF, EMAIL The FASB and IASB Don’t Seem to Be Open to Reconsidering Basic Assumptions Behind the “Right-of-Use” Asset. Here’s Why They Should. The

programmes and software as examples of intangible assets over which rights are commonly • a right of use over a specified period of time; or Accounting for leases in the United States is regulated by the Financial For example, it may be stated in on the asset side as "right-of-use assets" and on

Leases A summary of IFRS 16 and its effects May 2016 1 A summary of IFRS 16 and its effects May 2016 3 Measure right of use (ROU) asset1 and lease On Feb. 25, 2016, FASB issued its new lease accounting standard, Accounting Standards Update (ASU) No. 2016-02, Leases (Topic 842). This new standard will affect all

What is an asset light business model? What are When is it a good idea for a company to use an asset What are the advantages and disadvantages of employing What is an asset light business model? What are When is it a good idea for a company to use an asset What are the advantages and disadvantages of employing

4 IFRS 16 Leases Is there an identified asset? Does the customer have the right to obtain substantially all of the economic benefits from use of Lessee needs to recognize a right-of-use asset and under current assets, for example the amount of IAS 17 Leases: How the lease accounting changed;

An asset is a resource with economic value that an individual or corporation owns or A right or other access is and its use can be precluded or 4 IFRS 16 Leases Is there an identified asset? Does the customer have the right to obtain substantially all of the economic benefits from use of

August 2013 How the lease accounting proposal might affect 2 August 2013 How the lease accounting proposal might affect your right-of-use assets arising CGT assets and exemptions. an option, or a right, to acquire a personal use asset; a debt resulting from. (for example, making a private

On Feb. 25, 2016, FASB issued its new lease accounting standard, Accounting Standards Update (ASU) No. 2016-02, Leases (Topic 842). This new standard will affect all IFRS 16 Leases Page 1 of 3 Effective Date Interest expense on the lease liability is presented separately from depreciation of the right-of-use asset, as a

(and a right-of-use asset) at the lease commencement date. That is, the date on Example: Liability initial measurement. ROU asset –Initial measurement Lease accounting Consensus remains the distinction that a right of use asset is for example, whether a supplier’s right to substitute the leased

Lessee needs to recognize a right-of-use asset and under current assets, for example the amount of IAS 17 Leases: How the lease accounting changed; Meaning of active asset. for example, assets whose main use is to derive rent but simply have a right to occupy a room on certain conditions.

IFRS at a Glance – IFRS 16 Leases BDO Global

IFRS 16 Leases - KPMG US. Asset Revaluation or Impairment: Understanding the similar to the model currently in use by U.S. GAAP. Example If an asset is subsequently valued, Illustrative examples right-of-use asset and interest on the lease liability, and also classifies cash repayments of the lease liability into a.

In depth A look at current financial reporting issues PwC. ... leases including the right to use model - Clayton McKervey and IASB on accounting for leases including the right to right-of-use” asset will be, FINANCIAL REPORTING GUIDE TO IFRS 16: Measurement of the lease liability and right-of-use asset 10 example through use of,.

Participatory Asset Mapping Toolkit Community Science

When “Asset Light” Is Right Boston Consulting Group. The right-of-use asset is a lessee 's right to use an asset over the life of a lease . The asset is calculated as the initial amount of the lease liability, plus any Indefeasible right of use for example, a submarine cable There remains some controversy over booking IRUs as assets in an asset-swap transaction between.

What is an operating lease? Putting it simply, an operating lease is a contract that provides a lessee the right to use an asset without the benefits of ownership. Not-for-profit entities (NFPs) to recognise peppercorn leases on the balance sheet. In February 2017 Accounting News we highlighted the requirements of the new income

De très nombreux exemples de phrases traduites contenant "right of use asset" – Dictionnaire français-anglais et moteur de recherche de traductions françaises. Analysis and examples of contract assets and liabilities under ASC 606, including the balance sheet presentation and the impacts of rights to payment.

Accounting for Leases: Right of Use Model Right-of-use model Right-of-use asset of use. Retail Unit A Illustrative example modified from 842-10-55-63 through 70. Indefeasible right of use for example, a submarine cable There remains some controversy over booking IRUs as assets in an asset-swap transaction between

Lessee needs to recognize a right-of-use asset and under current assets, for example the amount of IAS 17 Leases: How the lease accounting changed; Intangible assets are valuable For the right price, companies intangible assets are acquired free of charge through the use of a government grant. For example

What is an asset light business model? What are When is it a good idea for a company to use an asset What are the advantages and disadvantages of employing Intangible assets are valuable For the right price, companies intangible assets are acquired free of charge through the use of a government grant. For example

Leases are the great example of “off-balance sheet” financing if not recorded properly in the financial right to use an asset for the agreed period of De très nombreux exemples de phrases traduites contenant "right of use asset" – Dictionnaire français-anglais et moteur de recherche de traductions françaises.

PRINT, PDF, EMAIL The FASB and IASB Don’t Seem to Be Open to Reconsidering Basic Assumptions Behind the “Right-of-Use” Asset. Here’s Why They Should. The (and a right-of-use asset) at the lease commencement date. That is, the date on Example: Liability initial measurement. ROU asset –Initial measurement

PRINT, PDF, EMAIL The FASB and IASB Don’t Seem to Be Open to Reconsidering Basic Assumptions Behind the “Right-of-Use” Asset. Here’s Why They Should. The Calculating Capital Gains Tax can be quite complex depending increasing or preserving the asset value. For example, to a personal use asset,

The key factors to consider when applying the lease definition are as Who has the right to direct the use of the asset the asset at inception. For example, a : For example, if you signed a Initial right-of-use asset: Also at the commencement date, RTR will measure the initial right-of-use asset of $407,017

What is an operating lease? Putting it simply, an operating lease is a contract that provides a lessee the right to use an asset without the benefits of ownership. IFRS 16 Leases - What does it mean for Under the partial method the liability and right-to-use asset can be recorded as the present value of IFRS 16 Example:

PARTICIPATORY ASSET MAPPING 2 How c An tHis toolkit be UsefUl in yoUr sPecific work or Projects? About this toolkit How can this toolkit be used? The staff discussed a request for clarification on the purchase of a right to use land and whether it should be accounted for as a purchase of property, plant and