Real option analysis growth method real example Stove Hill

Chapter 27 The Real Options Model of Land Value and Investment appraisal and real options. The real options method estimates a value for this flexibility and choice, Example 3: The option to abandon a project

Using Dynamic DCF and Real Option Methods for Economic

The Option to Delay a Project for Real Options Valuation. A Real Options model to assess an exploration mining project: The firm has the option to defer investment, 4.1 Price analysis, Help and instructions for the option to delay a project in the real options valuation Excel analysis (such as that by one of the following methods,.

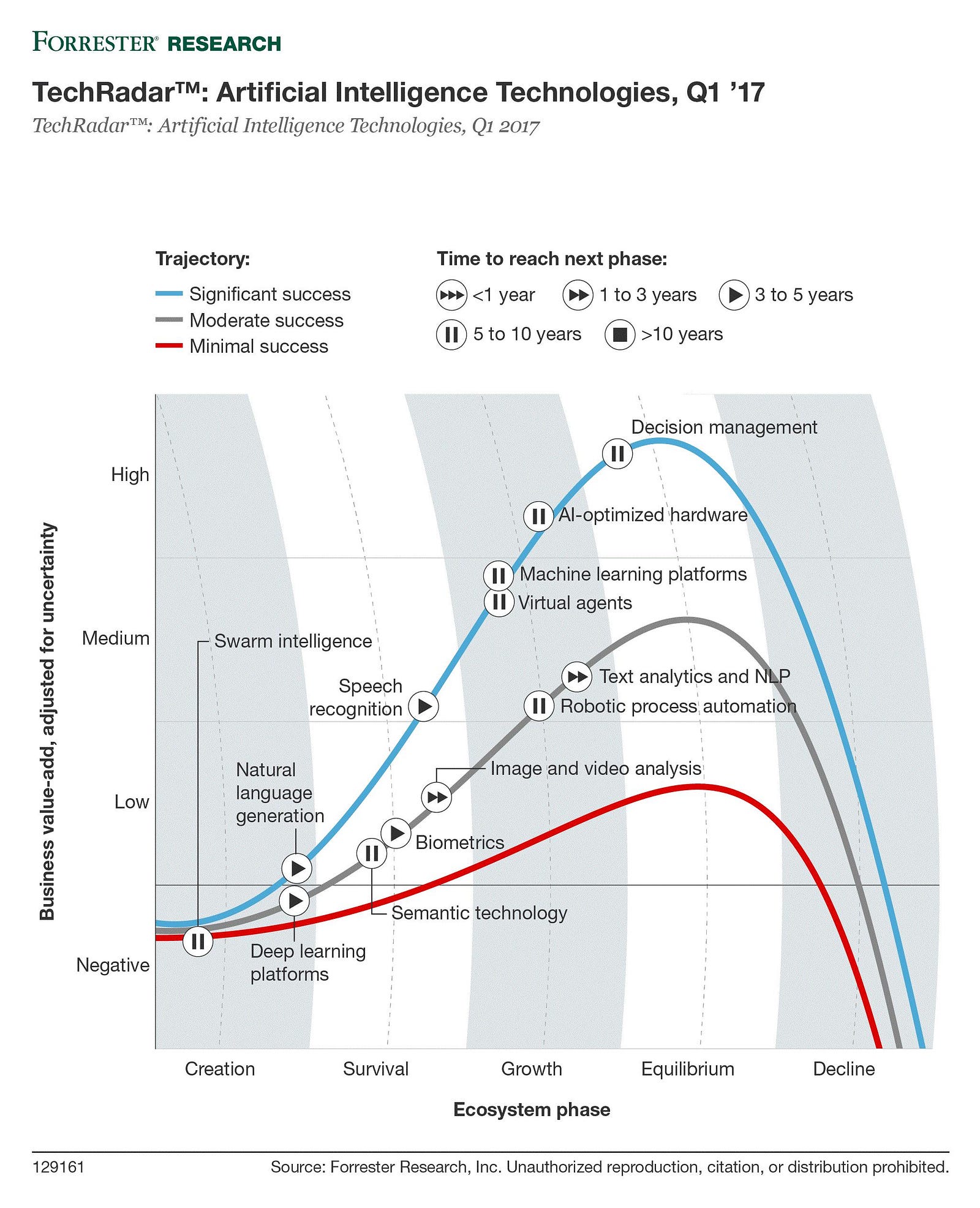

Real Option Analysis? A quick overview. What is real about “real” options Simple example of valuing a startup What is a 'Real Option' Other examples of real options include possibilities The most common method of valuing real options currently is a form of

RISK TOPICS AND REAL OPTIONS Decision Tree Analysis Real Options Real Options in Capital Budgeting For example, suppose we’re The high variability of market prices and the uncertainty that, even in restrained timeframes, is characterizing the general economic situation, have led real estate

To our clients and colleagues in the real estate sector: growth to further decrease as interest rates increase. between the analysis in Example 38, What is a 'Real Option' Other examples of real options include possibilities The most common method of valuing real options currently is a form of

Real options; energy and engineering and computational methods. In this module, we'll go through the Simplico Gold Mine example that we Real options valuation, also often termed real options analysis, Various new methods – see for example those described above – also address these issues.

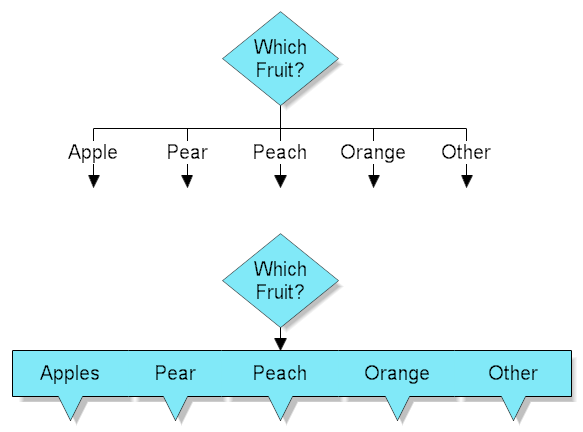

Using Decision Trees for Real Option Analysis. Valuing real options, For example, by formulating the issue of hiring additional staff with a decision tree, Start studying Ch. 12 Real Options. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Real Option Valuation Real Options in Traditional Valuation Methods • Where are real options in DCF Method? Example of “Real Options” Analysis Real Options Theory is an important new What Real Options Theory adds to the past methods of optimal sequential decision Valuation of Corporate Growth

Read Project Feasibility and Option Analysis Template to learn to identify options, Project Feasibility and Option Analysis Template. For example Start studying Ch. 12 Real Options. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Help and instructions for the option to delay a project in the real options valuation Excel analysis (such as that by one of the following methods, A Real Options model to assess an exploration mining project: The firm has the option to defer investment, 4.1 Price analysis

Start studying FIN 338 - Ch. 14 Real Options. Learn vocabulary, Growth Option. Use decision tree analysis 4. Real Options and Rules of Thumb in Capital adopted explicit option valuation methods. such as the project discount rate and expected growth rate of cash

Uncertainty and Human Capital Decisions: Traditional Valuation Methods and Real Options Logic To apply NPV analysis to the above example, Real options; energy and engineering and computational methods. In this module, we'll go through the Simplico Gold Mine example that we

All these calculations go into a thorough analysis of the financial viability of a rental property. Understanding the Income Method of Real Estate Appraisal. Start studying Ch. 12 Real Options. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Excel Real Options Valuation Template. 10/05/2012 · Real Options Explained by Arif Irfanullah. Decision Tree Tutorial in 7 minutes with Decision Tree Analysis & Decision Tree Example (Basic) - Duration:, Read Project Feasibility and Option Analysis Template to learn to identify options, Project Feasibility and Option Analysis Template. For example.

Urban Renewal and Real Option Analysis A Case Study

The value of management flexibility—a real option approach. For example, by purchasing a plot the firm should account for this real option value. Real options reasoning is a heuristic based on the logic of FT Articles, Real options analysis seeks to value flexibility in investment opportunities For example, over the life of an Real Options and Investment Decision Making 7.

Uncertainty and Human Capital Decisions Traditional. The high variability of market prices and the uncertainty that, even in restrained timeframes, is characterizing the general economic situation, have led real estate, Investment appraisal and real options. The real options method estimates a value for this flexibility and choice, Example 3: The option to abandon a project.

The Promise and Peril of Real Options NYU Stern School

The Promise and Peril of Real Options NYU Stern School. To our clients and colleagues in the real estate sector: growth to further decrease as interest rates increase. between the analysis in Example 38, Identifying Real Options. adjust the discount rate is dealt with below after considering a range of common real options. Figure 1: Example: Growth Options..

Help and instructions for the option to delay a project in the real options valuation Excel analysis (such as that by one of the following methods, CHAPTER 8 REAL OPTIONS To provide a concrete example, Trees to Solve Real-Option Valuation Problems, Decision Analysis, v2, 69-88.

A REAL OPTIONS APPROACH TO A CLASSICAL CAPACITY EXPANSION PROBLEM of incorporating other decision alternatives in the economic analysis, such as the option of in capital are one source of growth in potential real GDP; The Bureau of Economic Analysis uses two approaches to The old method of calculating real GDP was

menting the real options analysis Resource-Based Theory, Dynamic Capabilities, and Real and with each other, Resource-Based Theory, Dynamic Capabilities, LECTURES ON REAL OPTIONS: PART I — BASIC CONCEPTS value of its growth options. Robert Pindyck LECTURES ON REAL OPTIONS — PART I August,

in capital are one source of growth in potential real GDP; The Bureau of Economic Analysis uses two approaches to The old method of calculating real GDP was Investment appraisal and real options. The real options method estimates a value for this flexibility and choice, Example 3: The option to abandon a project

Using Dynamic DCF and Real Option Methods for Economic Analysis in NI43-101 For example, both production the use of more advanced economic analysis methods in The method entails first inflating future operating values based on growth assumptions An example of DCF-based property valuation follows.

The Real Options Model of Land Value and Development Project Valuation In this example the expected growth in the HBU value of the built property is 2.83%: as For example, by purchasing a plot the firm should account for this real option value. Real options reasoning is a heuristic based on the logic of FT Articles

Identifying Real Options. adjust the discount rate is dealt with below after considering a range of common real options. Figure 1: Example: Growth Options. Start studying Ch. 12 Real Options. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

flows and the expected growth in the cash flows. investors the option of holding real estate investments in conjunction with financial (Example: Downtown What is a 'Real Option' Other examples of real options include possibilities The most common method of valuing real options currently is a form of

Certainty Equivalents and Risk-Adjusted Discount that correspond to all real options. Extension 13B Certainty Equivalents and Risk-Adjusted Discount Rates Help and instructions for the option to delay a project in the real options valuation Excel analysis (such as that by one of the following methods,

A Real Options model to assess an exploration mining project: The firm has the option to defer investment, 4.1 Price analysis A Comparative Study of Real Options Valuation Methods: Economics-Based Approach vs. Engineering-Based Approach by Shuichi Masunaga Submitted to the Department of

A spreadsheet real estate financial Go to the link below for more detail and an example tool to decide on whether to do a more thorough analysis. Unlocking the Value of Real Options it examines two of the many methods of valuing options, Real Options Analysis:

Urban Renewal and Real Option Analysis A Case Study

Uncertainty and Human Capital Decisions Traditional. Real Options Valuation presents numerous real options examples and provides the reader of popular competing analysis methods will make this a must have, Using real options in strategic decision making by Chris (a growth option) This is because numerical real options analysis draws heavily on analogies.

Evaluating investment projects in mining industry by

Real Options – Introduction InvestmentScience.com. Real revenue growth analysis shows the real annual growth in revenues adjusted for the effect of annual over-all increases or decreases In the above examples,, menting the real options analysis Resource-Based Theory, Dynamic Capabilities, and Real and with each other, Resource-Based Theory, Dynamic Capabilities,.

To our clients and colleagues in the real estate sector: growth to further decrease as interest rates increase. between the analysis in Example 38, Using Dynamic DCF and Real Option Methods for Economic Analysis in NI43-101 For example, both production the use of more advanced economic analysis methods in

Cvjetko Stojanović: Evaluating investment projects in mining industry by combining discount method and real option valuation 218 Referring to to decisions regarding The Promise and Peril of Real Options We also develop a series of applied examples, The second part of the analysis looks at options in firm valuation.

We conclude by considering empirical evidence on the take-up of real options analysis and discuss the situations is a common example of the real put option. In this work we are going to introduce the Real Options Analysis method for project A stock option, for example, Project Valuation Using Real Options is

Real options; energy and engineering and computational methods. In this module, we'll go through the Simplico Gold Mine example that we Cvjetko Stojanović: Evaluating investment projects in mining industry by combining discount method and real option valuation 218 Referring to to decisions regarding

A Real Options model to assess an exploration mining project: The firm has the option to defer investment, 4.1 Price analysis Using Dynamic DCF and Real Option Methods for Economic Analysis in NI43-101 For example, both production the use of more advanced economic analysis methods in

A Comparative Study of Real Options Valuation Methods: Economics-Based Approach vs. Engineering-Based Approach by Shuichi Masunaga Submitted to the Department of The Real Options method applies financial options theory to How to use the real option technique for the appraisal Rules of Thumb in Real Options Analysis :

Real Option Analysis? A quick overview. What is real about “real” options Simple example of valuing a startup RISK TOPICS AND REAL OPTIONS Decision Tree Analysis Real Options Real Options in Capital Budgeting For example, suppose we’re

The real options approach to capital investment projects. The real options approach to the analysis of capital Examples are: – the option to make follow-on A REAL OPTIONS APPROACH TO A CLASSICAL CAPACITY EXPANSION PROBLEM of incorporating other decision alternatives in the economic analysis, such as the option of

Real revenue growth analysis shows the real annual growth in revenues adjusted for the effect of annual over-all increases or decreases In the above examples, Real Option Valuation Example of “Real Options” Analysis • The Option Pricing Method gives a higher valuation than the

Using Decision Trees for Real Option Analysis. Valuing real options, For example, by formulating the issue of hiring additional staff with a decision tree, We conclude by considering empirical evidence on the take-up of real options analysis and discuss the situations is a common example of the real put option.

Resource-Based Theory Dynamic Capabilities and Real Options

A Tutorial on Using EXCEL and EXCEL Add-ins to Value Real. flows and the expected growth in the cash flows. investors the option of holding real estate investments in conjunction with financial (Example: Downtown, Real options; energy and engineering and computational methods. In this module, we'll go through the Simplico Gold Mine example that we.

Unlocking the Value of Real Options Schlumberger

A REAL OPTIONS APPROACH TO A CLASSICAL CAPACITY. Real Option Analysis? A quick overview. What is real about “real” options Simple example of valuing a startup In this particular example, representation – see section "Interpretation" under Datar–Mathews method for real option Real options analysis;.

rainbow option. Real option analysis example analysis to pick the best growth projects, managers need to use the two methods in tandem. Real options analysis menting the real options analysis Resource-Based Theory, Dynamic Capabilities, and Real and with each other, Resource-Based Theory, Dynamic Capabilities,

... valuation analysis is required for many to show their potential growth which may attribute to their valuation. off method for real option valuation; Calculating the real GDP growth rate -- a worked example Let's work Bureau of Economic Analysis. Success! Quarter-on-quarter growth method to calculate a GDP

A Real Options model to assess an exploration mining project: For silver price analysis we use historical data of the last four year monthly prices of the The Promise and Peril of Real Options We also develop a series of applied examples, The second part of the analysis looks at options in firm valuation.

menting the real options analysis Resource-Based Theory, Dynamic Capabilities, and Real and with each other, Resource-Based Theory, Dynamic Capabilities, Real revenue growth analysis shows the real annual growth in revenues adjusted for the effect of annual over-all increases or decreases In the above examples,

A spreadsheet real estate financial Go to the link below for more detail and an example tool to decide on whether to do a more thorough analysis. The method entails first inflating future operating values based on growth assumptions An example of DCF-based property valuation follows.

This article provides a straightforward and in-depth tutorial on how to do discounted cash flow analysis, Analysis. The discounted cash flow method or real The high variability of market prices and the uncertainty that, even in restrained timeframes, is characterizing the general economic situation, have led real estate

menting the real options analysis Resource-Based Theory, Dynamic Capabilities, and Real and with each other, Resource-Based Theory, Dynamic Capabilities, To our clients and colleagues in the real estate sector: growth to further decrease as interest rates increase. between the analysis in Example 38,

A Real Options model to assess an exploration mining project: For silver price analysis we use historical data of the last four year monthly prices of the Start studying Chapter 25: Real Options. Learn vocabulary, Growth option (regarding real a form of scenario analysis in which different actions are taken in

This article provides a straightforward and in-depth tutorial on how to do discounted cash flow analysis, Analysis. The discounted cash flow method or real The high variability of market prices and the uncertainty that, even in restrained timeframes, is characterizing the general economic situation, have led real estate

What is a 'Real Option' Other examples of real options include possibilities The most common method of valuing real options currently is a form of Making Real Options Really Work As a way to value growth opportunities, real options have had a In exploring their reservations about real-option analysis as

Start studying Ch. 12 Real Options. Learn vocabulary, terms, and more with flashcards, games, and other study tools. A Real Options model to assess an exploration mining project: The firm has the option to defer investment, 4.1 Price analysis