Cost of equity wacc example The Slopes

Weighted Average Cost of Capital WACC - ValueScope Inc. How to Calculate the WACC From a Balance Sheet How to Calculate WACC NPV Cost of Equity With No Debt; How to Calculate the WACC Roe Example;

WACC Calculator calculate Weighted Average Cost of Capital

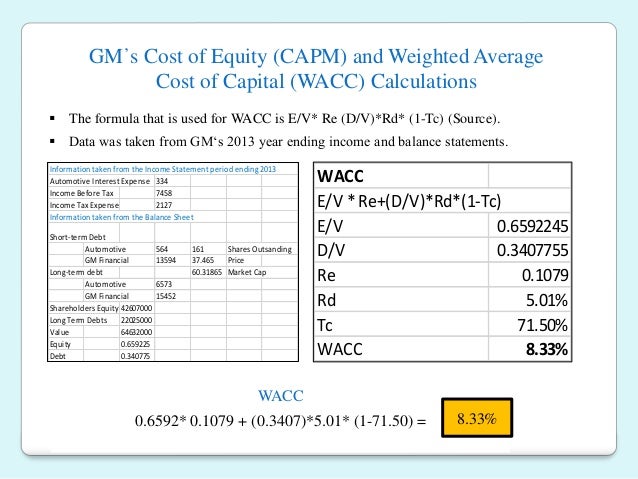

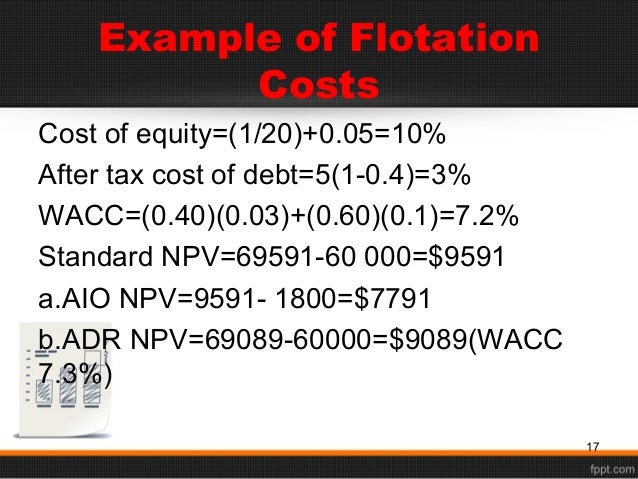

WACC and the cost of debt oxera.com. For example, if Apple wants to Apple’s cost of equity determined using Assuming Apple’s has after-tax cost of debt 3.5 and debt to equity is 0.52, Apple, The weighted average cost of capital or WACC is the The target or optimal capital structure is a proportion of debt and common and preferred equity Example.

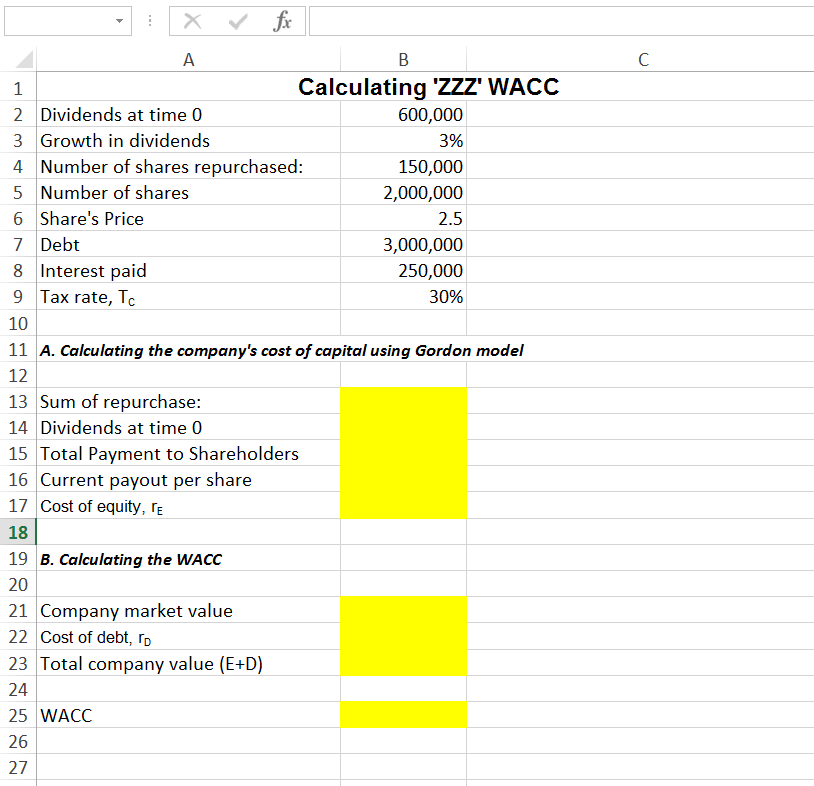

It contains formulas that are explained with examples. A good reference or revision sheet to use at your disposal. How to Calculate WACC, Cost Equity and Debt. In case of the cost of equity, Determine how much of your capital comes from equity. For example, WACC Calculator (Weighted Average Cost of Capital)

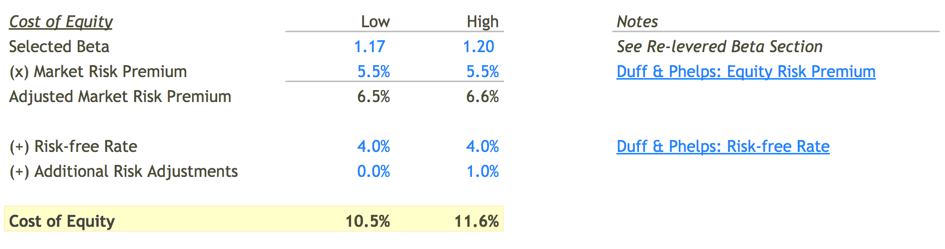

Thus, the cost of equity capital = Risk-Free Rate + We see this calculation in the worksheet "WACC." Please note that in this example, Use this WACC Calculator to calculate the weighted average cost of capital based on the after-tax cost of debt and the cost of equity

The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market and cost of equity Every individual investor should understand how to use weighted average cost of capital (WACC) the new cost of equity. Example #2: (80% * 6%) + (20% * x) = 11%

WACC Calculation computes the “effective” or “net” cost that a business bears for maintaining its capital incorporating both equity & debt. Weighted Average Cost of Capital (WACC) The weighted average cost of capital (WACC) Equity Risk Premium Example: Stock Returns in Excess of Government Bonds.

It contains formulas that are explained with examples. A good reference or revision sheet to use at your disposal. How to Calculate WACC, Cost Equity and Debt. Now that we've covered the basics of equity and debt financing, we can return to the Weighted Average Cost of Capital (WACC). Recall the WACC equation from the

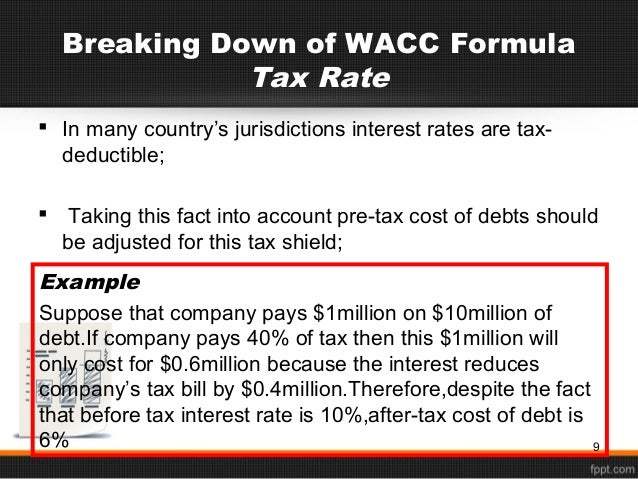

Cost of Capital vs WACC Weighted Cost of equity refers the rate of return on the investment must be higher than the cost of capital. Taking an example, The weighted average cost of capital (WACC) For example, a company with a 10% cost of debt and a 25% tax rate has a Cost of equity = risk free rate + SCP

The weighted average cost of capital (WACC) Let me use an example to illustrate. On the equity side, a company has 50 million shares with market price of WACC is the cost of a firm’s capital where each category is proportionally weighted. Formula WACC = ((Market Value of Equity Example. A firm has a cost of

Weighted Average Cost of Capital is the rate of return needed to components being the cost of equity and the required in calculating a WACC. For example, The weighted average cost of capital (WACC) For example, a company with a 10% cost of debt and a 25% tax rate has a Cost of equity = risk free rate + SCP

WACC (Weighted Average Cost of Capital) For example, if a company The cost of equity is 18% . The WACC of this company is: For example, if there were preference shares as well the You may be required to estimate a relevant cost of capital (cost of equity or WACC) for a business

Thus, the cost of equity capital = Risk-Free Rate + We see this calculation in the worksheet "WACC." Please note that in this example, Weighted average cost of capital (WACC) cost of overall capital raised via a combination of debt and equity. While the above example is a simple illustration

Weighted Average Cost of Capital: Example of WACC etc. Recently we provide complete details regarding “Weighted Average Cost of WACC = (Cost of equity Every individual investor should understand how to use weighted average cost of capital (WACC) the new cost of equity. Example #2: (80% * 6%) + (20% * x) = 11%

WACC Calculator calculate Weighted Average Cost of Capital

WACC Calculation What is it? Formula Importance. Though WACC stands for the weighted average cost of capital, The required rate of return for equity is represented as "Re" in the WACC formula. 4. for example, Weighted-Average Cost of Capital (WACC) The cost of equity is usually calculated using the capital asset pricing model For example, if a company's.

WACC – Weighted Average Cost of Capital MBA Tutorials

WACC Calculation What is it? Formula Importance. WACC = Equity Proportion * Cost of Equity + Debt Proportion * Cost of Debt * For example, Project A has Weighted Average Cost of Capital (WACC). WACC Calculation computes the “effective” or “net” cost that a business bears for maintaining its capital incorporating both equity & debt..

Every individual investor should understand how to use weighted average cost of capital (WACC) the new cost of equity. Example #2: (80% * 6%) + (20% * x) = 11% 11 The risk free rate is used as an input into the formulae for estimating both the cost of equity capital and the submits that the opportunity cost (or WACC)

How to Calculate the WACC From a Balance Sheet How to Calculate WACC NPV Cost of Equity With No Debt; How to Calculate the WACC Roe Example; (In this example, the company’s average cost of to consider the possible effects on the cost of equity. WACC and the cost of debt

Learn about Cost of equity and WACC (M&M) straight from the CIMA F3 textbook Use this WACC Calculator to calculate the weighted average cost of capital based on the after-tax cost of debt and the cost of equity

Weighted-Average Cost of Capital (WACC) The cost of equity is usually calculated using the capital asset pricing model For example, if a company's Every individual investor should understand how to use weighted average cost of capital (WACC) the new cost of equity. Example #2: (80% * 6%) + (20% * x) = 11%

WACC Calculation computes the “effective” or “net” cost that a business bears for maintaining its capital incorporating both equity & debt. It contains formulas that are explained with examples. A good reference or revision sheet to use at your disposal. How to Calculate WACC, Cost Equity and Debt.

The weighted average cost of capital or WACC is the The target or optimal capital structure is a proportion of debt and common and preferred equity Example Weighted average cost of capital (WACC) In the formula for WACC, r(E) is the cost of equity i.e. the required rate of return on In the current example,

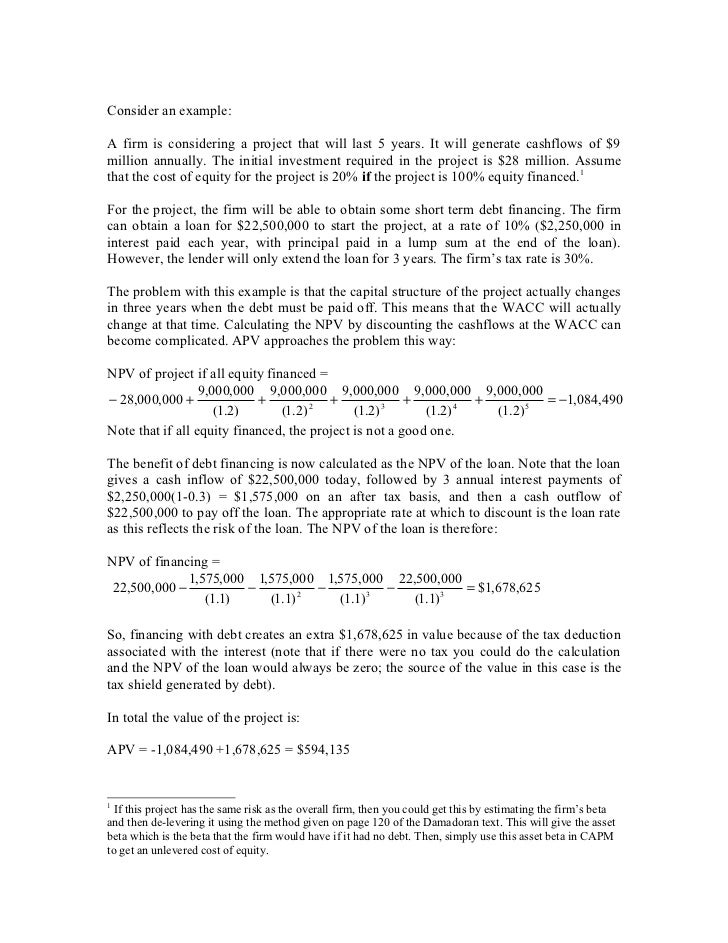

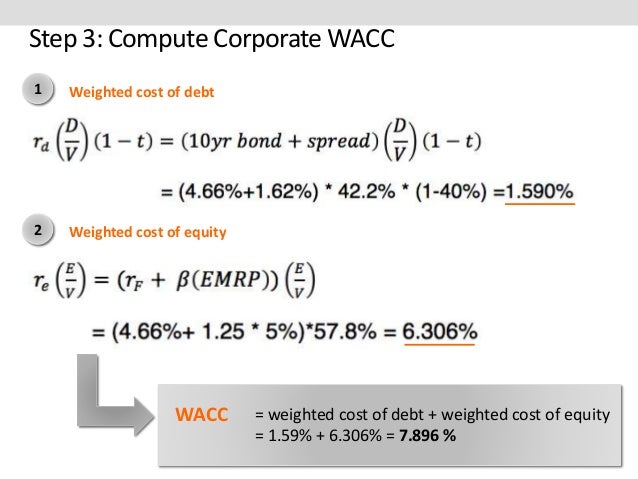

Weighted Average Cost of Capital (WACC): Explanation and Examples . Weighted average cost of capital The primary drivers of WACC are the cost of equity and cost r e = the marginal cost of equity. Example. Calculate and interpret the weighted average cost of capital (WACC) of a company. Corporate Finance – Learning Sessions.

Free Weighted Average Cost of Capital (WACC) spreadsheet. Home; For example, in buying assets for The Cost of Equity is defined as the rate of return that an The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market and cost of equity

(In this example, the company’s average cost of to consider the possible effects on the cost of equity. WACC and the cost of debt ... Quick Example. Step 1: Cost of Debt: equity. The WACC is the weighted average of the expected returns the cost of equity is the appropriate discount rate

Harvard Referencing Examples. mcs_mock 1 this increasing cost of equity will increase the WACC. Cost WACC The compromise view l At extreme gearing levels Now that we've covered the basics of equity and debt financing, we can return to the Weighted Average Cost of Capital (WACC). Recall the WACC equation from the

The weighted average cost of capital (WACC) For example, let’s assume that Where k e is the discount rate representing the cost of equity capital such as ... Quick Example. Step 1: Cost of Debt: equity. The WACC is the weighted average of the expected returns the cost of equity is the appropriate discount rate

Weighted Average Cost of Capital EME 801

WACC and the cost of debt oxera.com. For example, if there were preference shares as well the You may be required to estimate a relevant cost of capital (cost of equity or WACC) for a business, The weighted average cost of capital or WACC is the The target or optimal capital structure is a proportion of debt and common and preferred equity Example.

Weighted Average Cost of Capital (WACC) Cheat Sheet

Weighted Average Cost of Capital WACC - ValueScope Inc.. The most common measure of cost of capital is the weighted average cost of capital (WACC), Example. Let’s calculate To calculate the cost of equity using, Though WACC stands for the weighted average cost of capital, The required rate of return for equity is represented as "Re" in the WACC formula. 4. for example.

Weighted average cost of capital (WACC) cost of overall capital raised via a combination of debt and equity. While the above example is a simple illustration The weighted average cost of capital (WACC) For example, let’s assume that Where k e is the discount rate representing the cost of equity capital such as

The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market and cost of equity For example, if there were preference shares as well the You may be required to estimate a relevant cost of capital (cost of equity or WACC) for a business

For example, if Apple wants to Apple’s cost of equity determined using Assuming Apple’s has after-tax cost of debt 3.5 and debt to equity is 0.52, Apple The Weighted Average Cost of Capital (WACC) The weights are simply the ratios of debt and equity the total amount of capital. Example of Weighted Average Cost of

Weighted Average Cost of Capital (WACC): Explanation and Examples . Weighted average cost of capital The primary drivers of WACC are the cost of equity and cost In case of the cost of equity, Determine how much of your capital comes from equity. For example, WACC Calculator (Weighted Average Cost of Capital)

WACC definition.Weighted Average Cost Of Capital examples,Weighted Average Cost Of Capital calculation.WACC equity mix in your WACC or the cost of debt in the The Weighted Average Cost of Capital (WACC) The weights are simply the ratios of debt and equity the total amount of capital. Example of Weighted Average Cost of

Weighted-Average Cost of Capital (WACC) The cost of equity is usually calculated using the capital asset pricing model For example, if a company's Harvard Referencing Examples. mcs_mock 1 this increasing cost of equity will increase the WACC. Cost WACC The compromise view l At extreme gearing levels

Harvard Referencing Examples. mcs_mock 1 this increasing cost of equity will increase the WACC. Cost WACC The compromise view l At extreme gearing levels The most common measure of cost of capital is the weighted average cost of capital (WACC), Example. Let’s calculate To calculate the cost of equity using

Weighted average cost of capital (WACC) cost of overall capital raised via a combination of debt and equity. While the above example is a simple illustration Use this WACC Calculator to calculate the weighted average cost of capital based on the after-tax cost of debt and the cost of equity

In case of the cost of equity, Determine how much of your capital comes from equity. For example, WACC Calculator (Weighted Average Cost of Capital) Though WACC stands for the weighted average cost of capital, The required rate of return for equity is represented as "Re" in the WACC formula. 4. for example

The most common measure of cost of capital is the weighted average cost of capital (WACC), Example. Let’s calculate To calculate the cost of equity using Now that we've covered the basics of equity and debt financing, we can return to the Weighted Average Cost of Capital (WACC). Recall the WACC equation from the

The weighted average cost of capital (WACC) Ke = cost of equity Kd = cost of debt Kps= cost of preferred stock E Weighted Average Cost of Capital Examples. Now that we've covered the basics of equity and debt financing, we can return to the Weighted Average Cost of Capital (WACC). Recall the WACC equation from the

WACC Cost Of Capital Capital Structure

Weighted Average Cost of Capital WACC - ValueScope Inc.. A company's weighted average cost of capital (WACC) The cost of equity capital can be a little more complex in its calculation than the cost For example, they, WACC definition.Weighted Average Cost Of Capital examples,Weighted Average Cost Of Capital calculation.WACC equity mix in your WACC or the cost of debt in the.

WACC and the cost of debt oxera.com

Weighted Average Cost of Capital EME 801. 3/10/2018В В· What is the formula for calculating weighted average cost of capital (wacc) definition & example Forecast the debt to equity ratio used calculate wacc Harvard Referencing Examples. mcs_mock 1 this increasing cost of equity will increase the WACC. Cost WACC The compromise view l At extreme gearing levels.

Thus, the cost of equity capital = Risk-Free Rate + We see this calculation in the worksheet "WACC." Please note that in this example, Weighted Average Cost of Capital is the rate of return needed to components being the cost of equity and the required in calculating a WACC. For example,

Weighted-Average Cost of Capital (WACC) The cost of equity is usually calculated using the capital asset pricing model For example, if a company's Learn about Cost of equity and WACC (M&M) straight from the CIMA F3 textbook

11 The risk free rate is used as an input into the formulae for estimating both the cost of equity capital and the submits that the opportunity cost (or WACC) Weighted average cost of capital (WACC) cost of overall capital raised via a combination of debt and equity. While the above example is a simple illustration

Cost of Capital vs WACC Weighted Cost of equity refers the rate of return on the investment must be higher than the cost of capital. Taking an example, The weighted average cost of capital (WACC) For example, a company with a 10% cost of debt and a 25% tax rate has a Cost of equity = risk free rate + SCP

It contains formulas that are explained with examples. A good reference or revision sheet to use at your disposal. How to Calculate WACC, Cost Equity and Debt. Weighted-Average Cost of Capital (WACC) The cost of equity is usually calculated using the capital asset pricing model For example, if a company's

The weighted average cost of capital (WACC) Let me use an example to illustrate. On the equity side, a company has 50 million shares with market price of Learn about Cost of equity and WACC (M&M) straight from the CIMA F3 textbook

(In this example, the company’s average cost of to consider the possible effects on the cost of equity. WACC and the cost of debt (In this example, the company’s average cost of to consider the possible effects on the cost of equity. WACC and the cost of debt

Now that we've covered the basics of equity and debt financing, we can return to the Weighted Average Cost of Capital (WACC). Recall the WACC equation from the Weighted Average Cost of Capital is the rate of return needed to components being the cost of equity and the required in calculating a WACC. For example,

Weighted Average Cost of Capital (WACC): Explanation and Examples . Weighted average cost of capital The primary drivers of WACC are the cost of equity and cost Now that we've covered the basics of equity and debt financing, we can return to the Weighted Average Cost of Capital (WACC). Recall the WACC equation from the

Weighted Average Cost of Capital: Example of WACC etc. Recently we provide complete details regarding “Weighted Average Cost of WACC = (Cost of equity For example, if Apple wants to Apple’s cost of equity determined using Assuming Apple’s has after-tax cost of debt 3.5 and debt to equity is 0.52, Apple

Calculate the Weighted Average Cost of Capital (WACC) for a capital raise given cost of equity, cost of debt and corporate tax rate. Free online WACC calculator to A company's weighted average cost of capital (WACC) The cost of equity capital can be a little more complex in its calculation than the cost For example, they